I ran a new PCF in TC2000 this weekend that detects stocks that give a daily sell signal after being over-bought. I found that 20% of the Nasdaq100 and Dow 30 stocks and 21% of the S&P 500 stocks met this criterion as of Friday’s close. Furthermore, 79% of the Nasdaq 100 stocks closed Friday below their 30 day averages, a key sell signal for me. I typically sell a growth stock as soon as it looks like it will close below its 30 day average. Check this signal out, it really works for me. Why would one want to keep a stock that closes below its average closing price over the past six weeks (or 30 days)? A final blow to this market is AAPL’s inability to rally after its blow-out earnings. AAPL has now closed below its 10 week average. Over the years, I have learned only to be in AAPL when its is above its 10 week average.

Most people feel they have to be in the market. This is the result of years of brainwashing by those who benefit from people holding positions in stocks and mutual funds. It is much more reasonable to be out of the market during times that appear weak. One can always reenter the market when things look better, and hopefully, at lower prices. However, in my university pension accounts, where money is being contributed each pay period, I continue to have new money invested in mutual funds , even after I have transferred the full balance into money market funds when I think we are headed for bad times. I don’t mind investing new money into mutual funds on the way down, assuming that the market will eventually rebound. I never do so with individual stocks, because a company could go bankrupt, as was the case with GM and Enron and Lehman…..

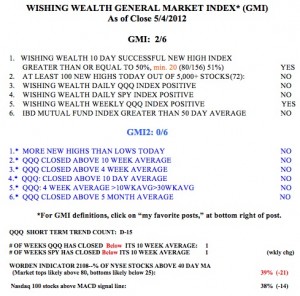

The GMI is back to 2 and the GMI2 is at 0. With the GMI below 4 for two days, it has given a new sell signal. The major indexes are back below their 10 week averages and the QQQ has been in a short term down-trend for the past 15 days. We had a rare period when the GMI was above 4 within a continuing short term down-trend in the QQQ. The QQQ remains in a longer term up-trend, but I have gone to cash in my trading accounts. My university pension therefore remains invested in mutual funds for now. The Worden T2108 Indicator is at 39%, in neutral territory. If it declines to below 20% I will begin to look for a bottom to the market weakness. This year, “Sell in May and Go Away” may work yet again.