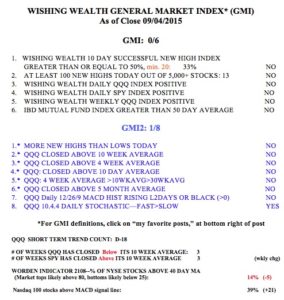

While it is impossible to accurately predict the length of any trend, technical indicators can help to assess the current short and long term trends of the market. The General Market Index (GMI) counts 6 indicators that have helped me over the years to diagnose the market trend. The GMI is now registering 0 (of 6). I have shown charts before that illustrated the value of my being out of the market during times when the GMI has flashed a Sell signal. The chart below shows how the QQQ has performed during times when the GMI was saying Buy (Green) versus Sell (red). I do not have an updated chart of the GMI signals. (Click on chart to enlarge.)

While not perfect, the GMI has been a good market indicator for me. Note that the GMI was on a Sell for most of the 2008 market decline. The GMI has been currently on a Sell since August 24. My short term QQQ trend indicator has signaled a short term down-trend for longer, now in its 18th day (D-18). When will this down-trend end–you know better than to ask… To be on the safe side I am almost 100% in cash in my trading accounts and the majority of my university pension is out of stock mutual funds and back in money market funds. Nevertheless, my new pension contributions keep buying mutual fund shares as they fall (dollar cost averaging)…….

While not perfect, the GMI has been a good market indicator for me. Note that the GMI was on a Sell for most of the 2008 market decline. The GMI has been currently on a Sell since August 24. My short term QQQ trend indicator has signaled a short term down-trend for longer, now in its 18th day (D-18). When will this down-trend end–you know better than to ask… To be on the safe side I am almost 100% in cash in my trading accounts and the majority of my university pension is out of stock mutual funds and back in money market funds. Nevertheless, my new pension contributions keep buying mutual fund shares as they fall (dollar cost averaging)…….

Pundits have been saying that ETFs are the way to go. They have lower fees than mutual funds and one can trade them during the market trading day. Sell or buy orders on mutual funds, however, are executed only after the market closes when the value of the fund portfolio can be accurately calculated. Well, during the Monday 8/24 flash crash I learned the negative consequence of this difference. The ETF basket of holdings is not calculated real time during the day. Orders are executed according to the buy and sell orders that come in and not according to the intrinsic value of the ETF’s holdings. Thus, on Monday, 8/24, when the market opened in a mini flash crash, my conservative (I thought) preferred stock ETF, PFF, which usually trades within a few cents each day, opened up at 38.52, down from the prior close of 39.01. In the first 10 minutes of trading, PFF traded as low as 32.32, only to close the 10 minutes at 36.81. PFF closed that day back at 38.26. Here is the bizarre daily chart of PFF.

This chart says it all about the vulnerability of ETFs during a market crash. PFF, composed of over 300 companies’ preferred stocks, was priced on Monday based on the hysteria of selling that had nothing to do with the intrinsic value of its holdings. Imagine what would have happened if I had placed a market order to sell or had a standing sell stop order in place to protect me against a small decline! I might have been sold out at a huge loss. This experience is enough to keep me away from most ETFs. At least orders to buy or sell a mutual fund will be executed based on a computation of that day’s closing values of all of its holdings. If you think my analysis is suspect, read this article from this week’s issue of Barron’s (click on: “The Great ETF Debacle Explained“) that describes this problem….

This chart says it all about the vulnerability of ETFs during a market crash. PFF, composed of over 300 companies’ preferred stocks, was priced on Monday based on the hysteria of selling that had nothing to do with the intrinsic value of its holdings. Imagine what would have happened if I had placed a market order to sell or had a standing sell stop order in place to protect me against a small decline! I might have been sold out at a huge loss. This experience is enough to keep me away from most ETFs. At least orders to buy or sell a mutual fund will be executed based on a computation of that day’s closing values of all of its holdings. If you think my analysis is suspect, read this article from this week’s issue of Barron’s (click on: “The Great ETF Debacle Explained“) that describes this problem….

This was not just with ETFs it was with most stocks. It is what we call Christmas for Market Makers! They open the price on the item way below value and start buying shares, then sell them at a huge profit as the day goes on.

Another potential downside to that latest “flash” crash is that more investors will now hesitate to use / enter stop loss orders. A future big down day in the markets might just be a time when a stop loss would be advantageous.

FWIW… I trade ETF’s and options exactly the same as short term mutual funds. Using only daily signals and placing all orders in the last 6 minutes of the trading day. Might not works for all others but my EOY returns have been better than they were when I had stop losses and worried about every minute moves.