I have TC2000 (see TC2000 tab on blog) draw a black dot when a stock in an up-trend bounces up from oversold. Oversold is defined as having a daily 10.1 stochastic value of 25 or less in any of the past 3 days. I have discovered that almost every significant rise in a stock begins from an oversold level. But not every oversold level leads to a big rise. Check it out for yourself. The key for me is to find a launched rocket near an all-time-high (ATH) that has become oversold and begins to move up. I can then buy it and place my stop loss below the low of the bounce. My recent TraderLion and Long Island Stock Traders Meetup presentation slides (see prior recent posts for the workshop links) show how to put a green dot indicator on a daily stock chart. Here is a copy of the slide with the link.

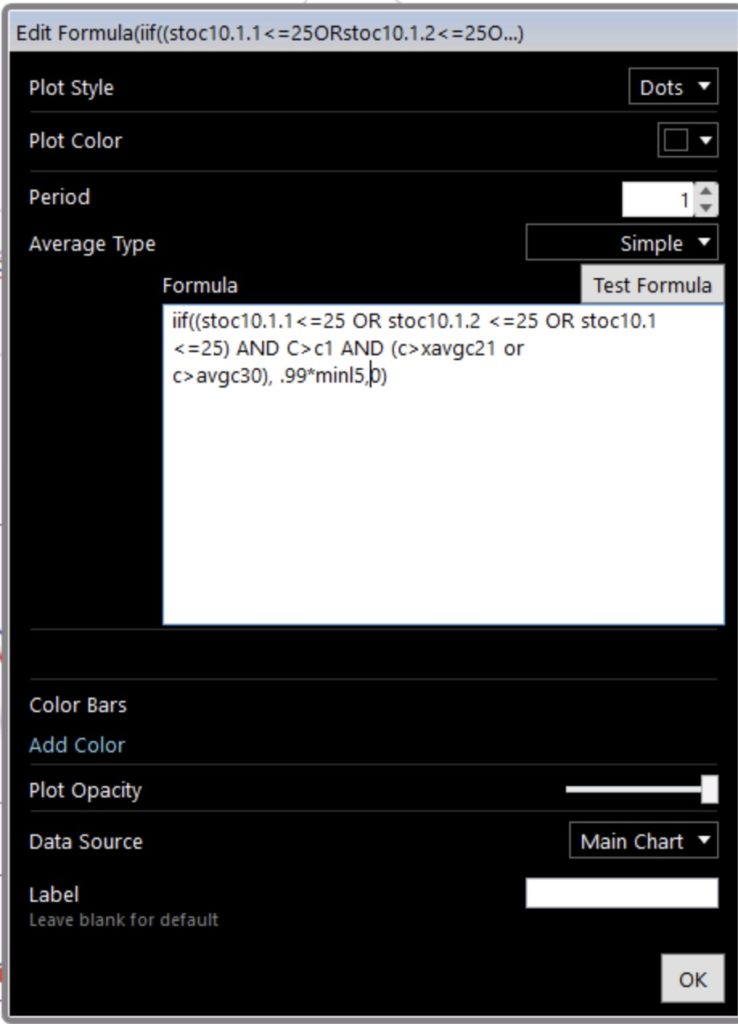

To create the black dot signal instead replace the formula in the tutorial with the logic:

I want the 10.1 daily stochastic in any of the last three days to be le25 and for the stock to be higher today than yesterday and to be above its 30 day simple average or its 21 day exponential moving average. The dot is placed at the 5 day low price.

Here are 2 examples of stocks with black and green dot signals. See if you can replicate them and then add the 10.1 stochastic indicator below the price. I love a black dot signal soon after a green line break-out (GLB). I have a TC2000 scan to identify such stocks.