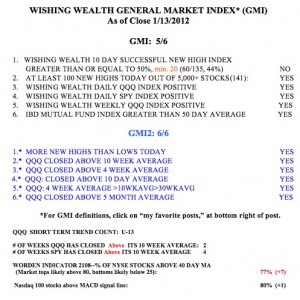

My indicators remain positive and I am 100% invested in mutual funds in my university pension account. I am gradually accumulating long positions in my trading accounts.  The GMI is at 5 and and the GMI-2 is at 6 (of 6). The GMI gave a buy signal on December 23rd and is still in place. The following 12 stocks passed my TC2000 scan of hitting new 52 week highs on Friday and having solid fundamentals: SMP,CMG,CCU,RGR,WPZ,RYN,PNRA,FAST,NGLS,M,USB,PETM. All but M and USB are at all-time highs. Some of these may be worth researching.

The GMI is at 5 and and the GMI-2 is at 6 (of 6). The GMI gave a buy signal on December 23rd and is still in place. The following 12 stocks passed my TC2000 scan of hitting new 52 week highs on Friday and having solid fundamentals: SMP,CMG,CCU,RGR,WPZ,RYN,PNRA,FAST,NGLS,M,USB,PETM. All but M and USB are at all-time highs. Some of these may be worth researching.

General Market Index (GMI) table

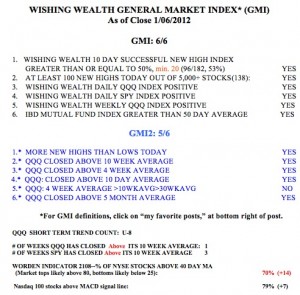

8th day of QQQ short term up-trend; GLD rebound over?

On December 23rd, the GMI flashed a buy signal.  I remain invested long in my university pension and hold several long positions in my trading accounts. AAPL has helped to drive the Nasdaq 100 index (QQQ) higher. GLD may be reaching the end of its rebound from oversold levels. With its stochastic at 89, I am looking for signs of a reversal before I short GLD.

I remain invested long in my university pension and hold several long positions in my trading accounts. AAPL has helped to drive the Nasdaq 100 index (QQQ) higher. GLD may be reaching the end of its rebound from oversold levels. With its stochastic at 89, I am looking for signs of a reversal before I short GLD.

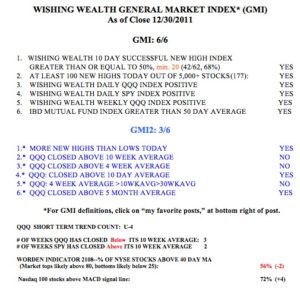

GMI at 6; WishingWealth GMI rocks; Gold in decline

The GMI remains at 6 and there is still a bullish signal in place. I reviewed the performance of the GMI during this break and found it to have performed quite well since I began posting it in 2006.  I will eventually publish the findings. For now, I will just say that the WishingWealth General Market Index (GMI) handily beat a buy and hold approach while reducing risk by keeping me out of the market during the major declines in this period. I will present the data and the key decision rules that I used, in my presentation at the Worden 2012 Conference in DC in April.

I will eventually publish the findings. For now, I will just say that the WishingWealth General Market Index (GMI) handily beat a buy and hold approach while reducing risk by keeping me out of the market during the major declines in this period. I will present the data and the key decision rules that I used, in my presentation at the Worden 2012 Conference in DC in April.

Meanwhile, the QQQ short term up-trend has now reached 4 days (U-4). Nevertheless, the QQQ has closed below its critical 10 week average for 3 weeks. In contrast, the SPY has closed above its 10 week average for 2 weeks. So, the large cap index has been outperforming the tech stocks, for now. The Worden T2108 indicator is at 56%, in neutral territory, and 72% of the Nasdaq 100 stocks closed with their MACD above its signal line, a sign of short term strength. However, the daily stochastic for the QQQ is nearing the overbought range and I think this two week rebound from oversold may be coming to an end. With the GMI-2 at 3, I remain cautious now with only a few hedged long positions. My university pension still remains invested in mutual funds, for now.

If you want to see why I am bearish on gold, take a look at this daily GMMA chart of GLD.

(Click on chart to enlarge.) Note that the short term averages (red) are far below the longer term averages (blue). Prior recent support levels have been broken. The multi-year up-trend has likely ended and I own a put option on GLD.