Every time I open my browser it opens the marketwatch.com webpage. This site is a wonderful way to keep up on the trend of the market during market hours. It also has many great articles. However, I am struck by the number of pundits who have recently written about the tough market that we have and how weak and dangerous it is. While I often read such articles, it is important for me to remind myself that no one knows what the market will do in the future. The best I can do is to use technical analysis to determine the current and recent trend of the market. Trends tend to continue along—until they don’t! The only way I know to interact with the market is to stay on the side of the current trend and to manage my position size and exit points as the trend strengthens or weakens.

Now, how can one measure the trend? It depends first on one’s time horizon. Day traders need to look at intraday trends using hourly or even 5 minute bars on the chart. I am too old to attempt such tactics, which are to me the equivalent of flying with the Blue Angels. I cannot react fast enough and I sure do not want to spend every second of the trading day watching my stocks and reacting. As a Boomer, I want to enjoy other things in my life, and even continue to teach and do research, but I still want to manage my investments, and my financial future, but only part-time.

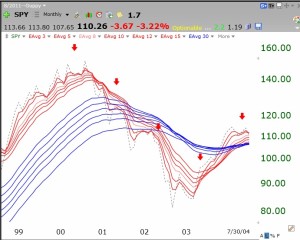

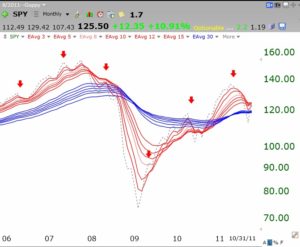

I therefore have adopted for many years Stage Analysis, the method first advocated by Stan Weinstein in his 1980’s classic book (posted to the lower right of this page). Stage analysis relies on examining the weekly chart of a stock. Each bar on the chart represents the high and low of the equity during each week. It is noteworthy that William O’Neil, founder of IBD and a very successful investor, has said that he uses weekly charts to discern the trend. With Stage Analysis, one plots both the weekly price bar, which shows the high and low of each week, and the 30 week moving average of closes over the prior 30 weeks (usually each Friday’s close). As each new week is added, the close from 31 weeks ago is dropped as the most recent week’s close is added, thus the average moves along each week. It turns out that as long as prices remain above the 30 week average and the average is rising, the market is in a Stage 2 up-trend. As long as the major index ETF’s remain in a Stage 2 advance I leave my conservative university pension in mutual funds. I do not care what the media pundits are saying, or try to out guess Mr. Market. (This does not stop me from trying to beat the market in my trading accounts, by exiting and entering even during a Stage 2 advance.)

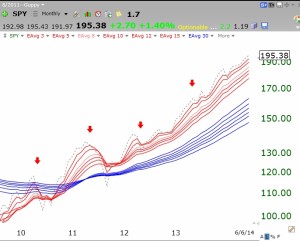

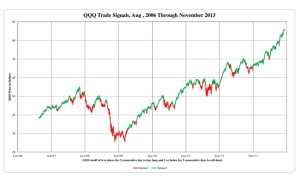

With the above as a context, what does Stage Analysis say about the market over the past year? It is clear that the SPY (S&P500 index ETF) and DIA (DJ-30 index ETF) have been in a steady Stage 2 up-trend since early 2013. The solid red line is the 30 week average.

Stage 2 in the QQQ (Nasdaq 100 ETF) really started going strongly a little later, in mid 2013.

Stage 2 in the QQQ (Nasdaq 100 ETF) really started going strongly a little later, in mid 2013.

All three of these indexes are clearly now in a Stage 2 up-trend and remain above their rising 30 week averages. The pundits are bemoaning the fact that the past few months since the beginning of 2014 the indexes have been relatively flat. These indexes are all up over 30% since 2013 and the pundits seem to think that they should always be climbing at this super rate! No!!! A health market rises and consolidates over and over again.

So I remain invested in mutual funds in my most conservative pension accounts and ignore the ever present cacophony generated by the media pundits. I once heard Steve Forbes say that his grandfather told him it is much easier to make money from the market by selling advice. Hence the plethora of writers and market prognosticators who have rarely walked their talk………..

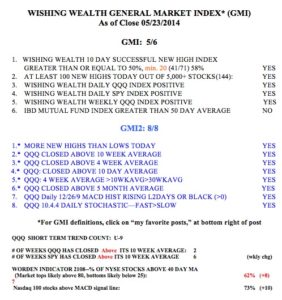

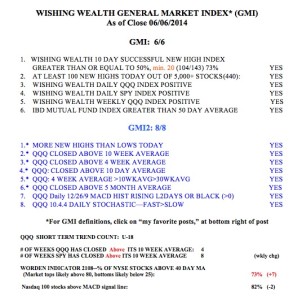

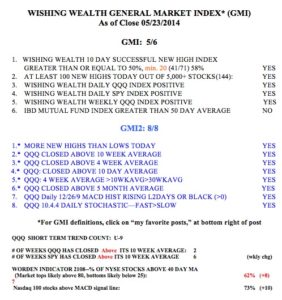

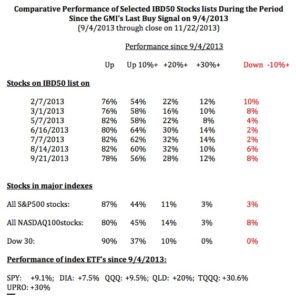

Now back to my trading oriented numbers. The GMI statistics remain strong, with a Buy signal in place since 4/22. My short term trend count for the QQQ is U-9, 9th day of the current short term up-trend. The people at IBD still call the market in a correction, as they wait for a strong volume up day (follow through day).