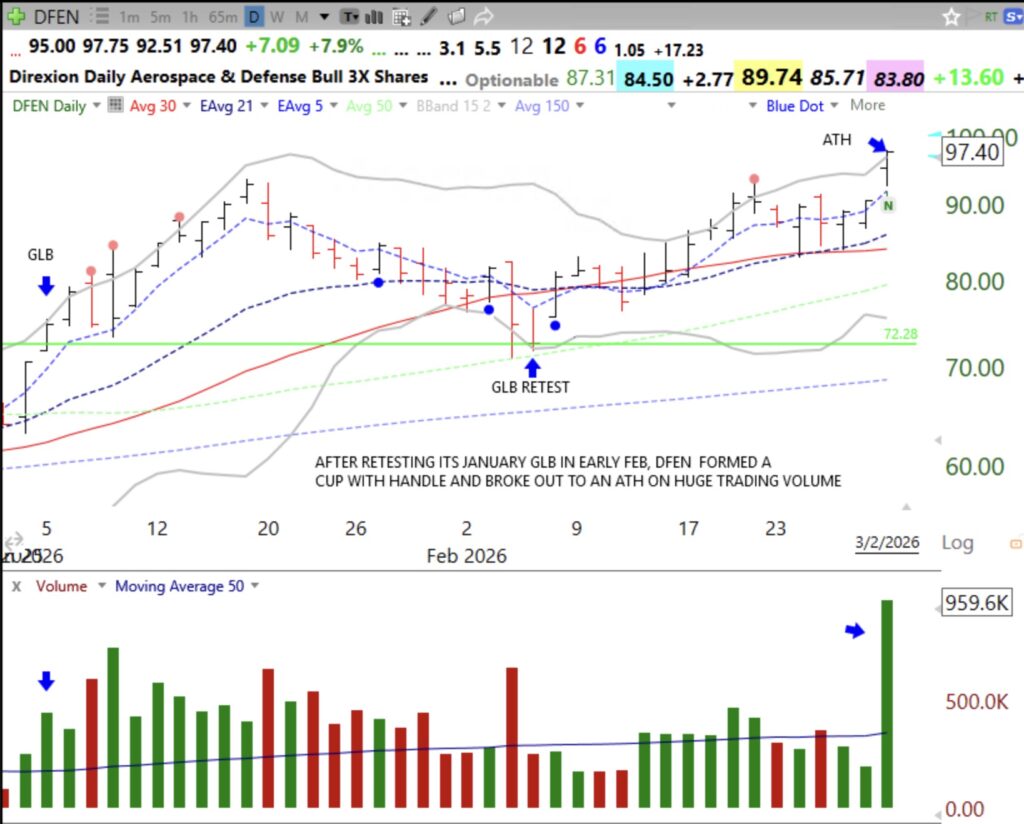

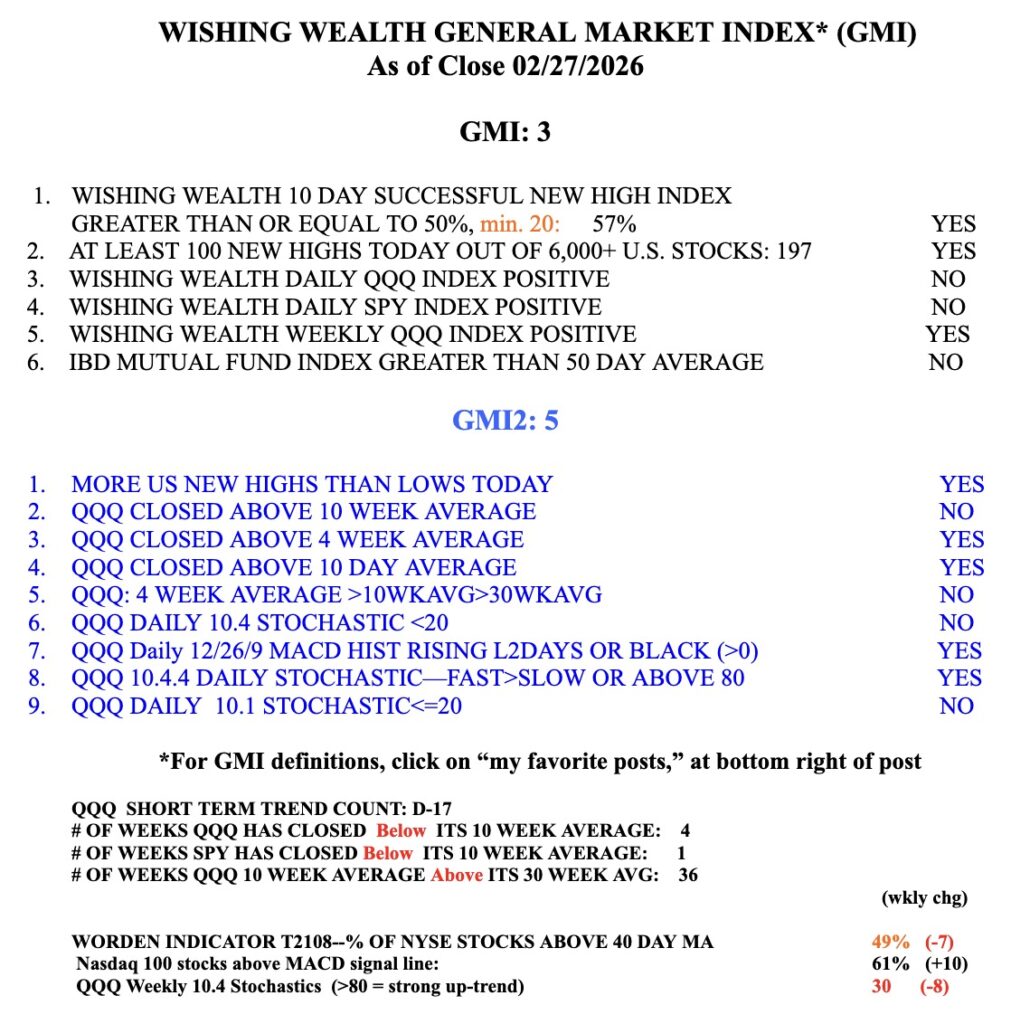

Every night I use TC2000 to filter 6,300+ US stocks to find those hitting an ATH that day. Sectors with many stocks reaching an ATH are attracting buyers. I only am interested in stocks that have recently reached an ATH. To understand this strategy, look at the evidence I posted in my 2025 TraderLion presentation on Day 6. Stocks at an ATH are showing incredible relative strength and there is no overhead supply of sellers to stop it. Fewer than 200 stocks out of 6,000+ US stocks typically trade at an ATH on any given day. Today, only 86 stocks did so. The last time more than 100 did so was on February 9. So with so many aerospace/defense stocks trading at an ATH on Monday, I looked at the 3x bullish leveraged ETF for such stocks and found this wonderful cup and handle break-out. Many break-outs fail in a down-trend, but with an expanding war in Iran and huge break-out volume this setup might work.