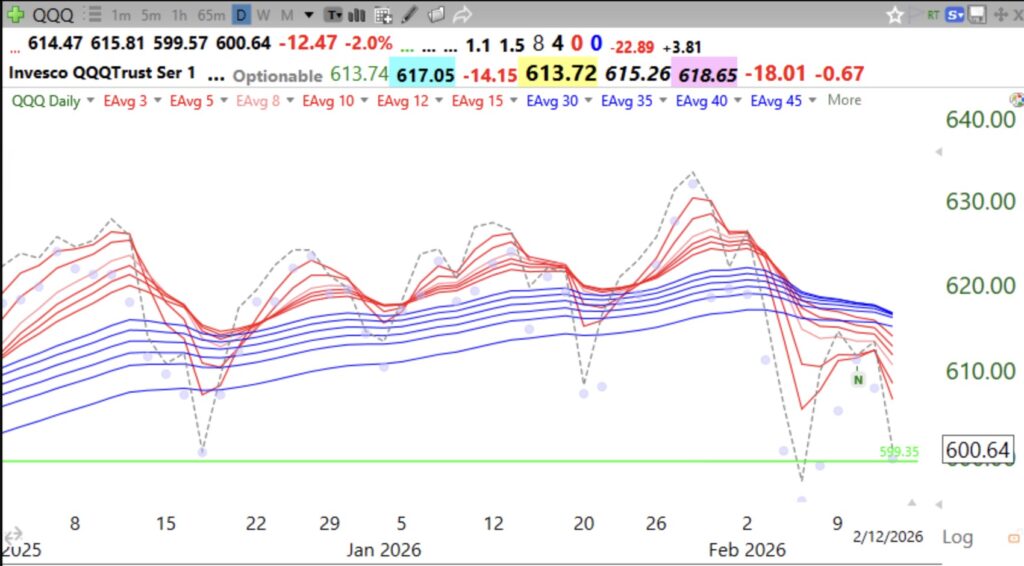

The shorter averages (red) are now declining below the longer averages (blue) with a white space between them. Hence the BWR down-trend. The dotted line is the daily close. Time to be on the sidelines in my trading accounts. My university retirement funds remain in mutual funds, for now.