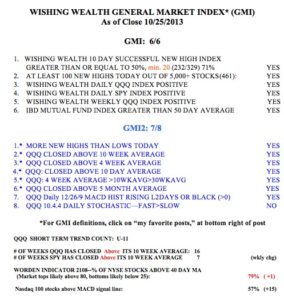

Here are the latest GMI and GMI-2 components. Indexes bounced from over-sold on Friday. But will they hold???

General Market Index (GMI) table

Market at critical juncture; MACD and Stochastics weakening; What will TSLA do–buy a call?

This is the time when the Sell in May crowd should be returning to the market. But sentiment is very bullish, with few bears to be seen. And my nieghbor, a great contrary indicator, is now looking to get back into the market. The last time he was so excited and wanted to take out a home equity loan to invest was near the 2000 top. To be sure, there are no technical signs of a top yet. But it is possible that we will get some weakness the next few weeks now that earnings are largely out. Let’s see if TSLA rebounds when earnings come out on Tuesday. A number of high flyers have hit air pockets recently , including CMI, SAM, SRCL, ROP, ORLY, NVO, PRAA, and LNKD.

There are a number of technical signs suggesting at least short term weakness. Take a look at this daily chart of the QQQ. I highlighted two areas of concern. Area 1: The daily MACD is showing weakening momentum with the possibility that the histogram will turn negative. Area 2. The fast daily stochastics has turned below the longer stochastics. Both of these indicators are showing weakening strength in the up-trend. (These indicators paint a similar picture for AAPL, not shown.)

It does not mean that the QQQ short term up-trend will end, only that at least a brief consolidation may be coming……

It does not mean that the QQQ short term up-trend will end, only that at least a brief consolidation may be coming……

Meanwhile the GMI is at 5 (of 6). However, note that the QQQ has closed above its 10 week average for 17 weeks. That is a long time. The Worden T2108 is at 65%, down from a high of 82% reached on 10/22.

TSLA just found support at the lower Bollinger band that I follow (15,2). But it is below its declining 30 day average (red line). Will this level hold when earnings are released on Tuesday? TSLA closed at 162.17 on Friday. November 8, 160 weekly calls are expensive, at around $10.75. Break even on these calls would therefore be at $170.75 (160+10.75) , excluding commissions. Can TSLA break 170.75 by Friday? Stay tuned….

TSLA just found support at the lower Bollinger band that I follow (15,2). But it is below its declining 30 day average (red line). Will this level hold when earnings are released on Tuesday? TSLA closed at 162.17 on Friday. November 8, 160 weekly calls are expensive, at around $10.75. Break even on these calls would therefore be at $170.75 (160+10.75) , excluding commissions. Can TSLA break 170.75 by Friday? Stay tuned….

11th day of QQQ short term up-trend; gold turning up?; EHTH gains strength and WYNN retests green line; GMI buy signal leads to large gains

The market remains in short and longer term up-trends. I hold a position in TQQQ , protected by put options. This should be an interesting week with earnings expected from AAPL and FB. I think GLD (ETF for gold) looks like it may be turning up. Check out this daily chart. Among the positives are that GLD is now back above its 30 day average (red solid line), the past 7 days have had large volume up days, and the MACD histogram has turned positive (black bars) the past 6 days. I own call options on GLD. Click on chart to enlarge.

I noticed that EHTH has been having some high volume advances after its recent green line break-out. Obamacare’s problems may be good for its bottom line. Check out this daily chart. T o find out more about green line charts, watch my free TC2000 December 2012 webinar. A link to the webinar appears to the right of my post.

On Friday, WYNN had a high volume retest of its green line break-out. Will it hold? Here is its daily chart.

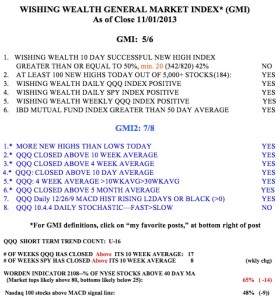

Finally, here is the GMI table, which shows a lot of strength in my indicators. The GMI has been on a buy signal since the close on September 4. Since then, the QQQ has advanced +8.07%, the QLD +17% and the TQQQ +25.92%. In contrast, the SPY has advanced only +6.15% and the DIA +4.2%. Riding a leveraged index ETF during a sustained up-trend has proven very profitable to me. Of course, my put options protect my position and let me sleep at night. Check out the performance of the GMI based strategy here.