This chart shows the 10 week average above the 30 week and QQQ (gray line) is leading both higher. I ignore the news and just watch the market’s action.

Stock Market Technical Indicators & Analysis

This chart shows the 10 week average above the 30 week and QQQ (gray line) is leading both higher. I ignore the news and just watch the market’s action.

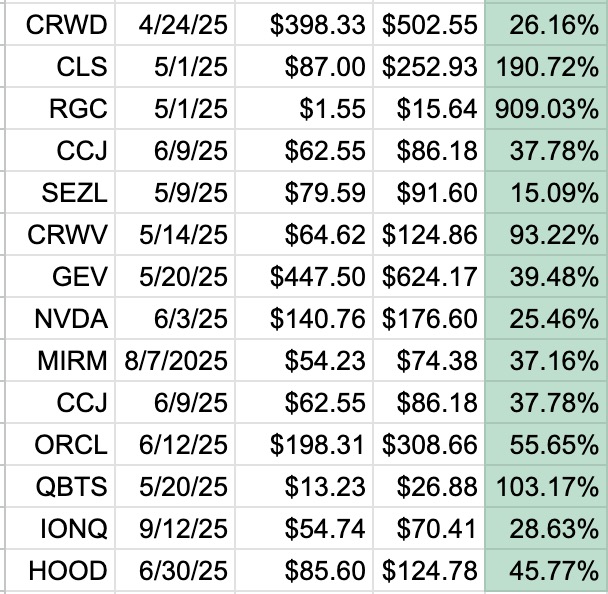

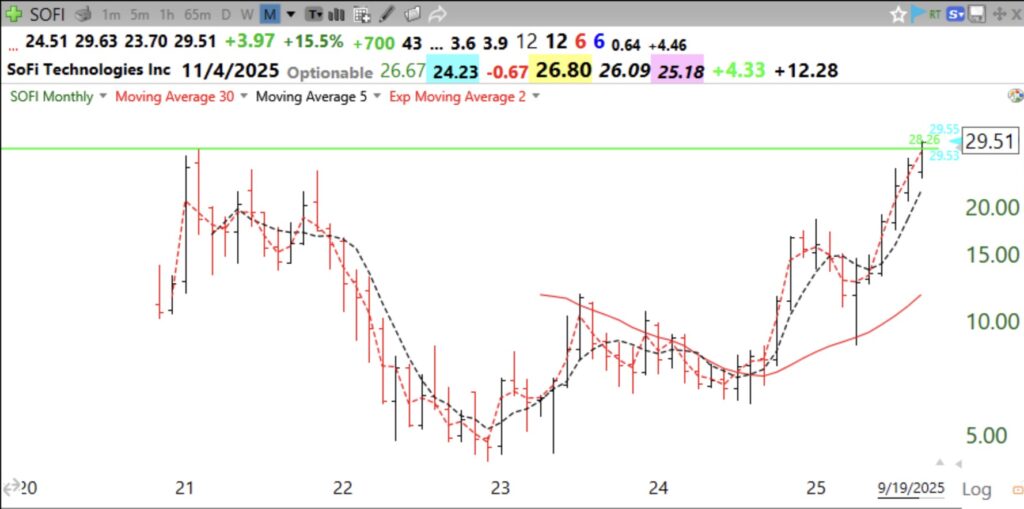

These are some stocks that had a GLB (green line break-out) and kept rising. While not all GLBs are successful, one can buy a GLB immediately and sell if the stock CLOSES back below the green line. That is how to limit losses. Green lines are drawn on a monthly chart at an ATH that is not surpassed for at least 3 months. When the stock then goes to a new ATH, especially on increased trading volume, that is when I like to buy. Below is a list of some successful GLBs in 2025, showing the green line value and last Friday’s close and % increase. After that is a chart of SOFI which had a GLB last Friday, although there was not a large increase in trading volume. SOFI has an IBD COMP rating=99. Check it out.

Here are the monthly and daily charts of SOFI. Green line is at $28.26.

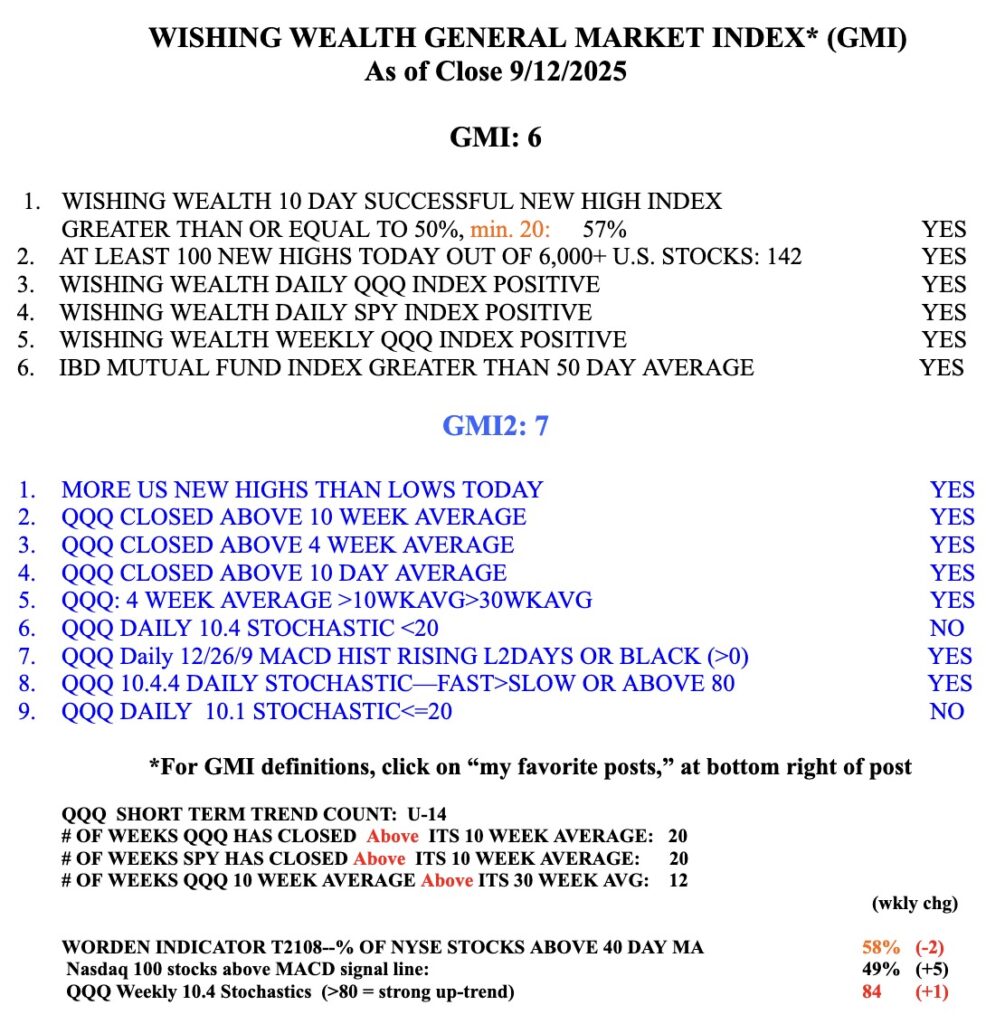

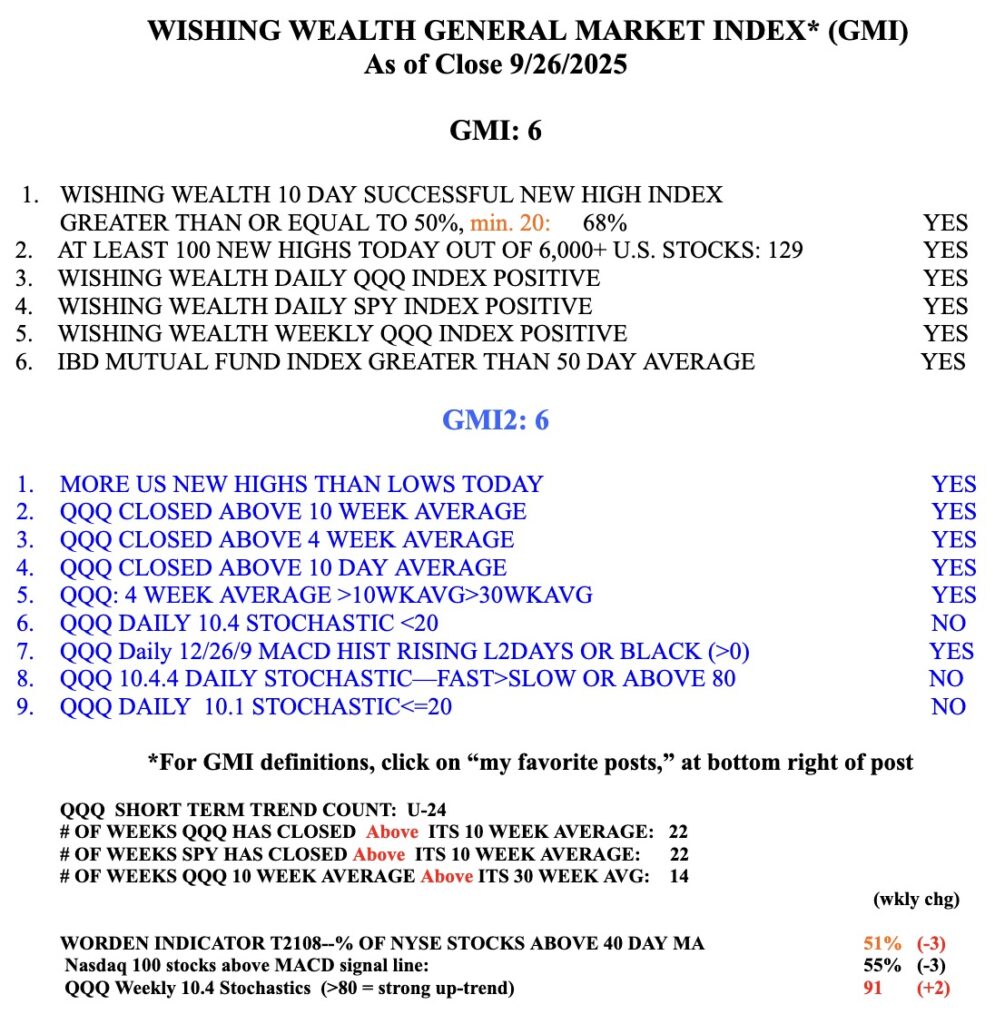

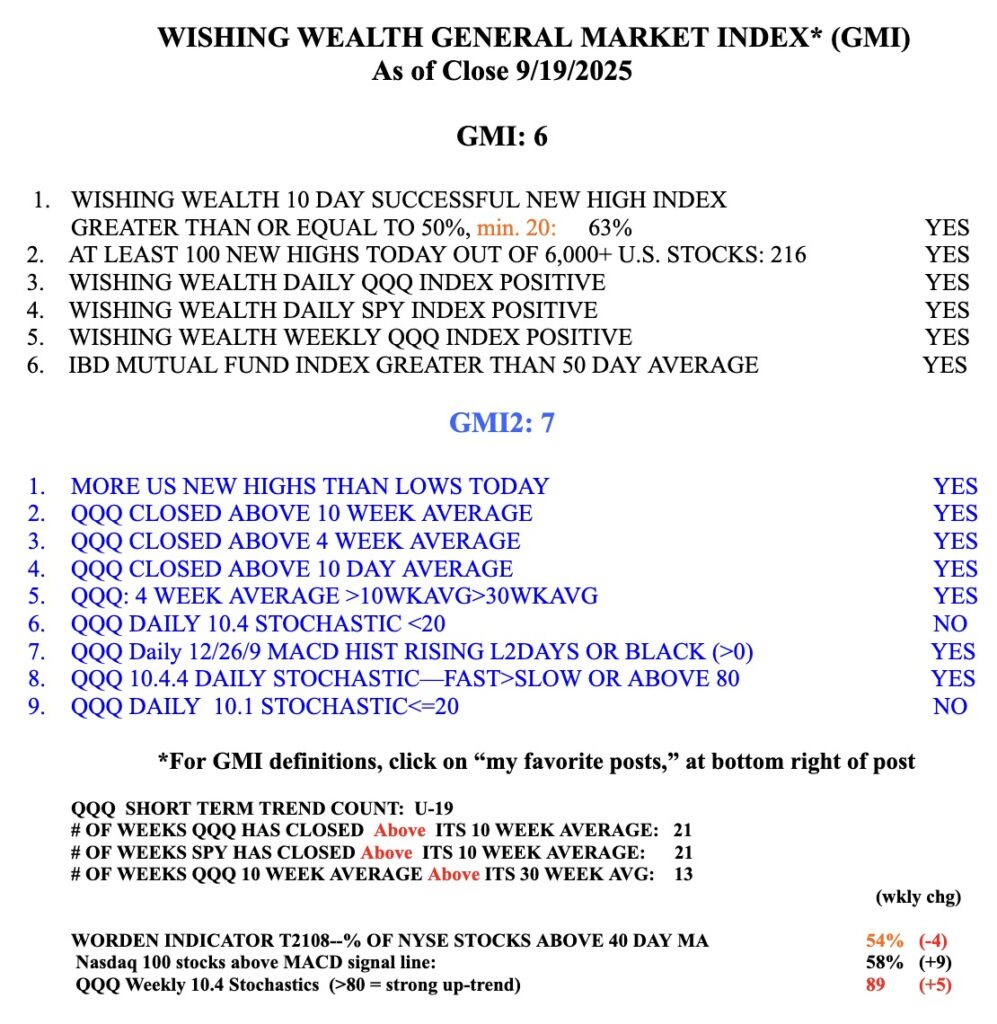

The GMI=6 (of 6).

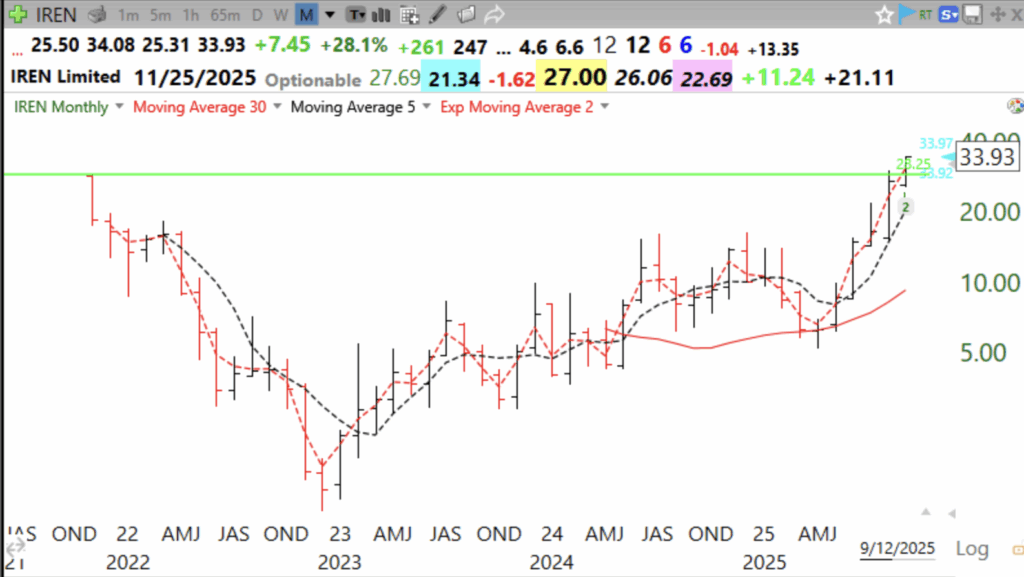

IREN has high volume advances and is trending with its 5 EMA. It is almost 5x its price a year ago. It has strong fundamentals, check it out. Below are its daily and monthly charts. It must not CLOSE below green line @28.25.