I have noticed that stocks that are advancing have the following pattern: x8 day average>x21 day average >30 day average. I learned about the significance of the 8 day exponential average from Pat Walker, who presented to my class and did this wonderful interview with my former student, Richard Moglen. The CAN SLIM team at IBD discovered the value of the X21 day. My use of the x8 with the x21 and the 30 day simple average is my own set-up and do not blame any of them if it doe not work for you.

Look at COST and you will see that the 3 averages line up since May 2 and COST never closed below the 8 since then. Using this set-up one would buy on a day that COST bounces up off of the 8, as it did on Thursday and Friday. I might buy COST Friday or Monday and sell if/when COST closes back below the 8. The blue arrows show all of the times there was a bounce up off of the 8.

The beauty of this and any set-up is that it tells me the stock should move up right away and when to sell with a small loss if it fails.

Think this only works with COST? Take a look at ANF.

And $NVDA

The key is to find a strong stock that has been finding support at its x8 day. I use TC2000 to scan for such gems. Check out CVLT that came up on today’s scan. Stocks need to have the above set-up, be up at least 50% from last year and have reached an ATH within the last 5 weeks. Before I buy, I also look at the MS fundamentals to make sure this is a thriving company.

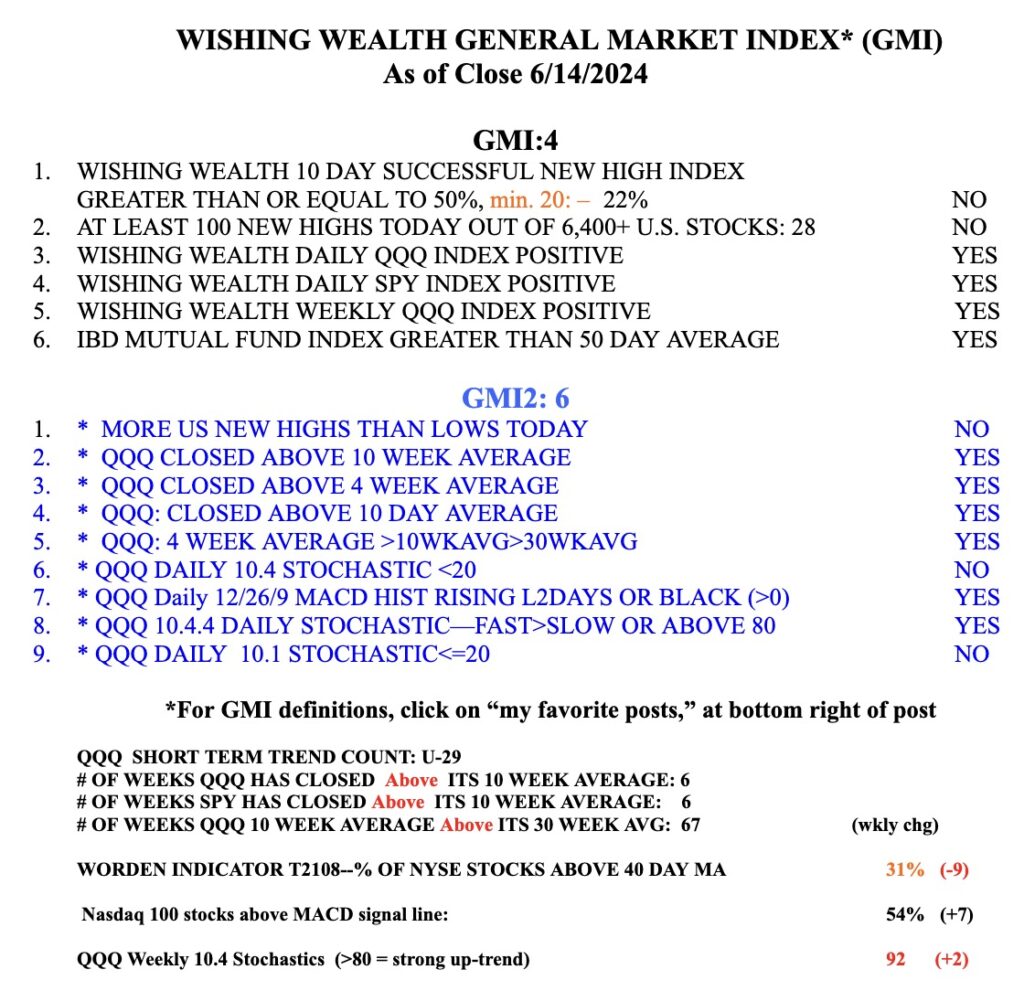

The GMI is at 4 (of 6) because not enough stocks are hitting new highs. That is a concern. Note also that T2108 is only at 31%. Happy Father’s Day to all of you.

Would have been nice to also display the TC2000 code for your scan in full.