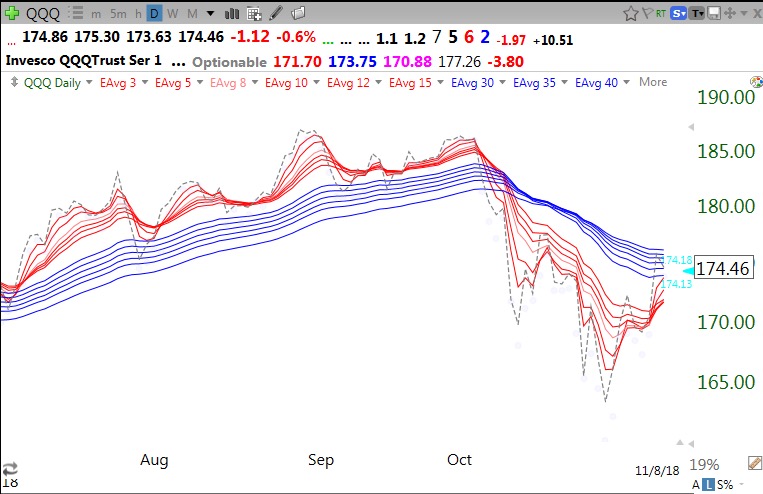

But no new daily RWB pattern yet.

Share this:

- Click to email a link to a friend (Opens in new window) Email

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to print (Opens in new window) Print

- More

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Reddit (Opens in new window) Reddit

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on WhatsApp (Opens in new window) WhatsApp

Dr. Wish – in the case of a BWR daily pattern but a GREEN GMI/GMI2 – which one do you defer to?

Does the BWR take precedence over the Green GMI (and GMI2) – or vice versa – in terms of stepping into the market?

Do BOTH criteria (RWB and positive GMI/GMI2) have to be met before you decide that it is “safe” to wade back into the market?

Additionally, how long do you have to see a RWB daily trend before you think there is a confirmed trend?

Thank you

Reg

Great questions but no set answers or I could program a computer to trade. Depends on my risk tolerance at any time. GMI is a priority because most stocks follow the market trend. Many daily indicators like green dot eventually fail in a down-trend.