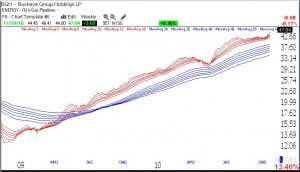

With the rise in the price of commodities, and especially oil, a lot of oil and gas related stocks hit new highs on Wednesday. Twenty of the 173 stocks in my universe of 4,000 stocks that hit a new high on Wednesday were in the oil and gas industry. Of these stocks, 5 were also on my cumulative IBD100 or New America watch lists : SPN, BGH, SXL, EPB and INT. All of these stocks have the important RWB pattern typical of launched rockets. A GMMA weekly chart of BGH appears below as an example. All of the short moving averages (red lines) are well above the rising long term averages (blue), with a white space separating them.

Month: November 2010

Up-trend intact as stocks weaken

T2108 declines to 75%. Holding positions as stocks weaken a little. Longer term trend remains up.

45th day of up-trend; Market looks extended

This market looks extended to me after the post-election gap up (see daily chart of Nasdaq 100 index ETF, QQQQ, below; click on chart to enlarge.) I have sold calls on my position in QLD (Ultra long QQQQ ETF) and am not adding any new positions in my IRA trading account. I would not be surprised to see some weakness between now and the end of December. Near the end of December we could see strength from end of quarter window dressing by mutual funds and from expectations for the release of 4th quarter earnings. Nevertheless, the GMI and GMI-R remain at their maximum levels. With the market in a longer term up-trend, I remain fully invested in mutual funds in my university pension account.