AAPL’s green line is at 237.23.

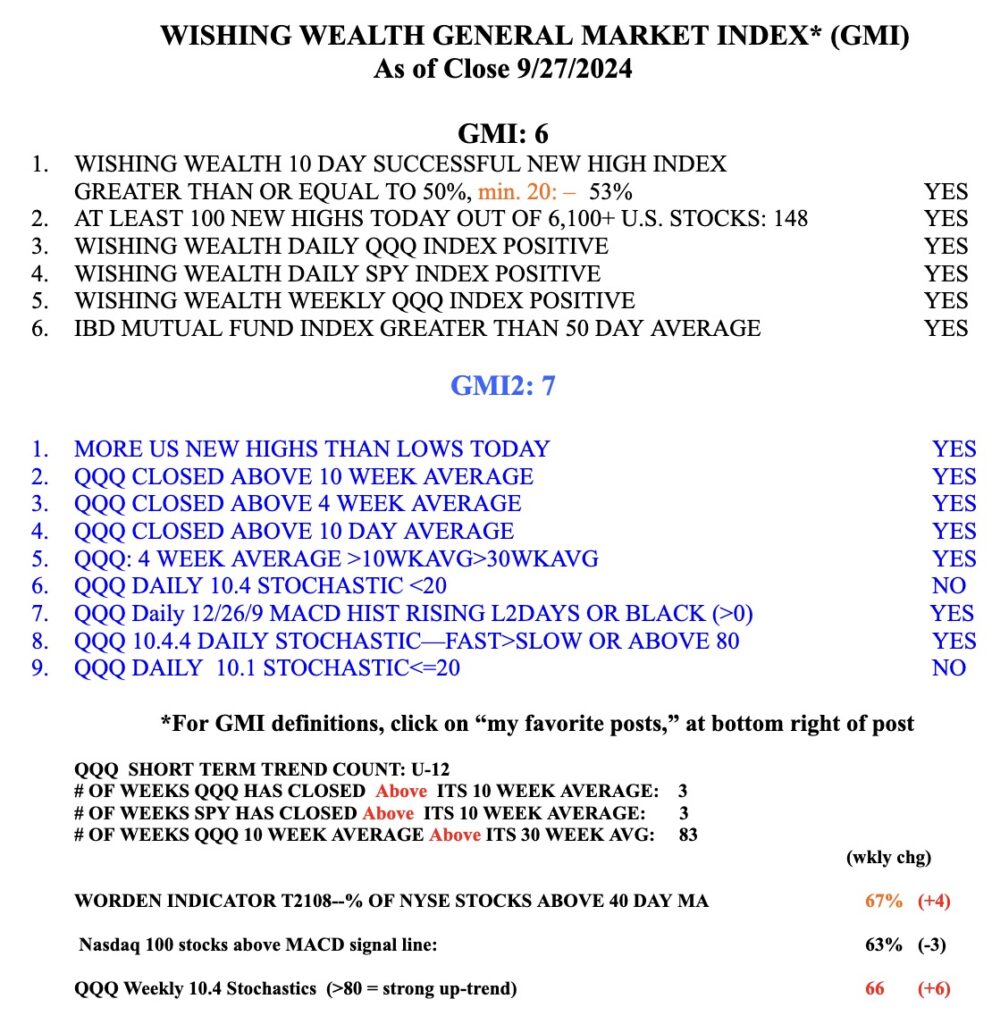

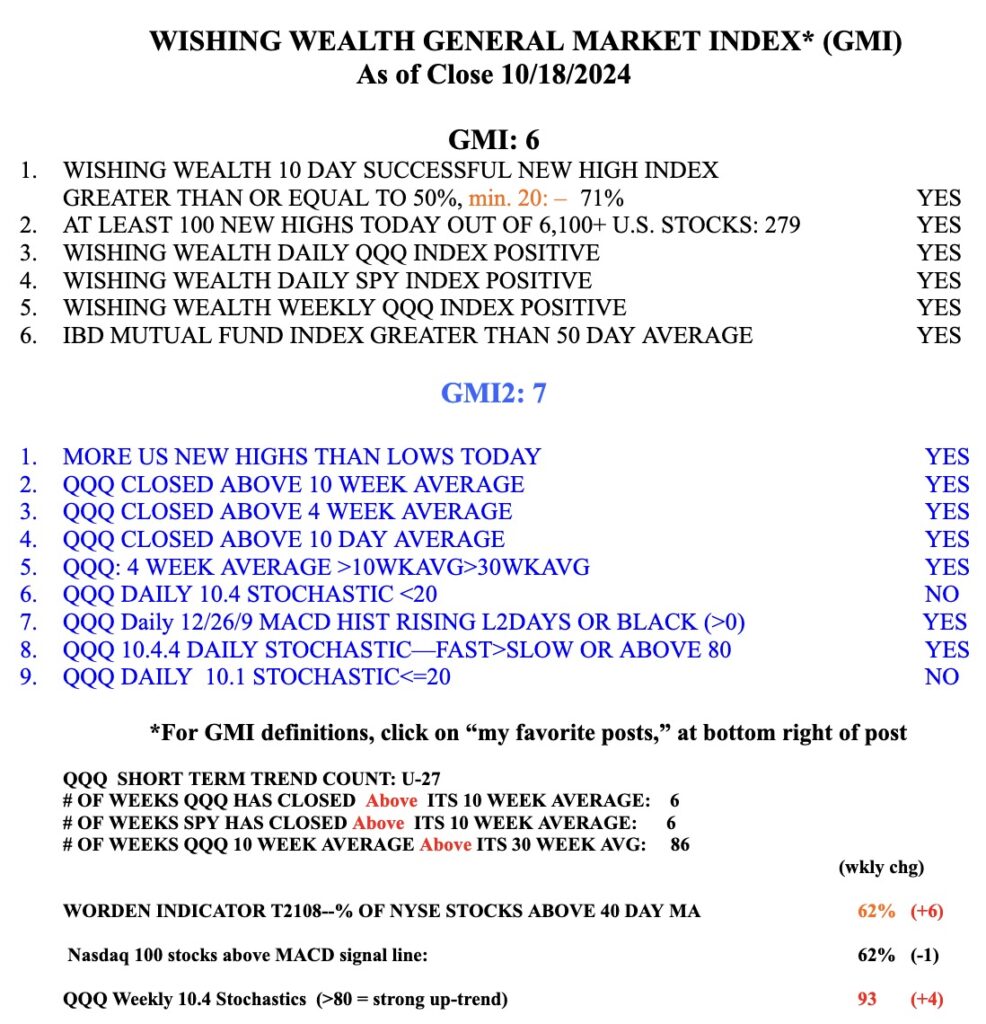

Stock Market Technical Indicators & Analysis

I teach my students that if they miss buying at the time of a GLB, a possible place to buy is when the stock subsequently has a weekly green bar setup. This means that the 4wk>10wk>30 wk and the 4 wk is rising and it had a 20 week high in RS (SPY). The stop loss would be placed just below that week’s low. This assumes one also likes the fundamentals.