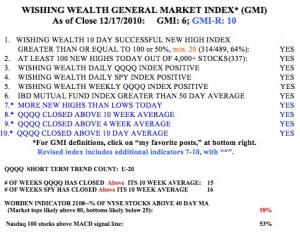

The GMI and GMI-R remain at their maximum values.  The last 2 weeks of December may bring strength for the leaders as mutual funds acquire them as part of end-of-quarter window dressing. The only warning signal I see now is the rise in bullish sentiment. The latest Investors Intelligence poll shows 56.7% of advisers are bullish. Rates near 60% often come near market tops. However the Worden T2198 indicator is only at 58%, in neutral territory. The key for me is to wait for a definite change in trend and not to try to anticipate one. So, I remain 100% long in my university pension and hold a position in QLD in my IRA trading account.

The last 2 weeks of December may bring strength for the leaders as mutual funds acquire them as part of end-of-quarter window dressing. The only warning signal I see now is the rise in bullish sentiment. The latest Investors Intelligence poll shows 56.7% of advisers are bullish. Rates near 60% often come near market tops. However the Worden T2198 indicator is only at 58%, in neutral territory. The key for me is to wait for a definite change in trend and not to try to anticipate one. So, I remain 100% long in my university pension and hold a position in QLD in my IRA trading account.

Month: December 2010

Options expiration today; Wednesday was 18th day of QQQQ short term up-trend; ABV

On to end of year/quarter mutual fund window dressing. My next post will be Monday morning.

I bought some January deep in-the-money call options on ABV yesterday. It may be breaking our of a multi-week consolidation. Yesterday, though, there was little increase in volume as it rose. If it falls back, I will sell. Click on this daily chart to enlarge.

QQQQ short term up-trend reaches 17th day.

While all of my market indicators remain positive, the leaders appear to be stalling. Option expiration comes on Friday and I am looking for a strong end of quarter/year.