The market remains in a down-trend. I am in cash and/or completely hedged. It looks like “sell in May and go away,” is working this year.

Month: June 2011

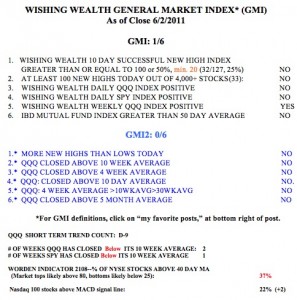

GMI at 0 for first time since August 31, 2010; in cash or short

The GMI has come back to zero for the first time since last year’s correction/decline ended in August. This doe not mean that we have hit the end of the decline. The GMI was at or near zero a lot of the time between May and August, 2010 before the beginning of the September to February rise. The T2108 is now at 30%, last August it got as low as 38% but in May it got as low as 10%. So we are not at an extreme oversold level yet on T2108. In addition, the latest Investors Intelligence poll only shows 20% bears, a low level. Bottoms occur at much higher levels of bearish sentiment.

By my definition, the QQQ short term down-trend just completed its 10th day. There were 5x more new lows than new highs on Monday in my universe of 4,000 stock (80 to 15). I am therefore mostly in cash and expect my put protected long positions to be assigned at options expiration. The people who sold me put options for a few dollars will have to buy my shares from me at the strike prices of the options which are considerably above the current prices of my stocks. It is time for me to sit patiently on the sidelines and wait for the GMI to recover to 4 or more before I go long again. If I were prone to more aggressive trading, I would have begun to accumulate QID when the short term trend turned down.

9th day of QQQ short term down-trend; GMI at 1; in cash and hedged; time to buy I bonds with a 4.6% yield?

With the GMI bearly (pun intended) at 1 and the GMI2 at 0, this is no time to be long stocks in my trading account. During the rally that began last September and for most of the next 6 months the GMI was around 6 and registered as low as 2 on only one day in that entire period. During that time my accounts prospered.  But now, with the GMI at 1 and with as few as only 22 new highs on Friday in my universe of 4,000 stocks, this is not the time to be buying growth stocks near new highs. Stocks that hit new highs are very unlikely to keep hitting new highs. So, I am forced to the sidelines in cash in my trading accounts. If I could repeatedly buy and sell in my university pension account, I would even move a little out of mutual funds and into money market funds. In such instances, I still allocate new university contributions to equity mutual funds so that I dollar cost average into them as prices fall. Then, when the bottom is in, I slowly reinvest the large sum of money that I had moved out at the beginning of the decline.

But now, with the GMI at 1 and with as few as only 22 new highs on Friday in my universe of 4,000 stocks, this is not the time to be buying growth stocks near new highs. Stocks that hit new highs are very unlikely to keep hitting new highs. So, I am forced to the sidelines in cash in my trading accounts. If I could repeatedly buy and sell in my university pension account, I would even move a little out of mutual funds and into money market funds. In such instances, I still allocate new university contributions to equity mutual funds so that I dollar cost average into them as prices fall. Then, when the bottom is in, I slowly reinvest the large sum of money that I had moved out at the beginning of the decline.

The new 6 month rate for U.S. Government I-bonds is now an unbelievable 4.6%! I may put some savings into I-bonds, as I believe the U.S. Government will continue to make good on its debt payments. Just be sure to read up on the purchase maximums and withdrawal rules.