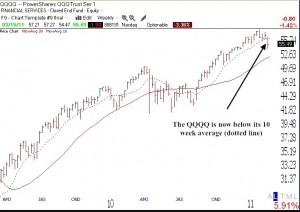

The QQQQ completed the 8th day of its short term down-trend on Thursday. In that period the QQQQ has fallen -4.8%, the SPY by -3.6% and the DIA by -3.5%. These indexes are down even more from their February closing highs (QQQQ – 7.2%, SPY -4.9% and DIA -4.8%). Of course, the inverse ETF’s advanced greatly during this period. Since I identified the QQQQ short term down-trend as beginning on March 8, TYP has increased by +18% and SQQQ by + 15%. I remain mainly in cash and in some QID in my IRA trading account. The longer term trends of the QQQQ, SPY and DIA remain in a Stage 2 up-trend.

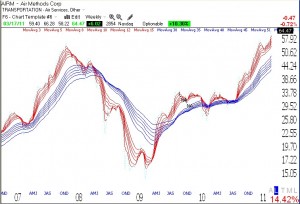

I was looking at the daily new high list from Thursday and noticed an incredible cup-with-handle break out formation. When it announced earnings a few days ago, AIRM broke out of a beautiful pattern to an all-time high on daily volume which was many times its average volume. I will keep an eye on this stock for a possible purchase when the market down-trend ends.

AIRM is also an RWB rocket stock. Click on weekly chart to enlarge.