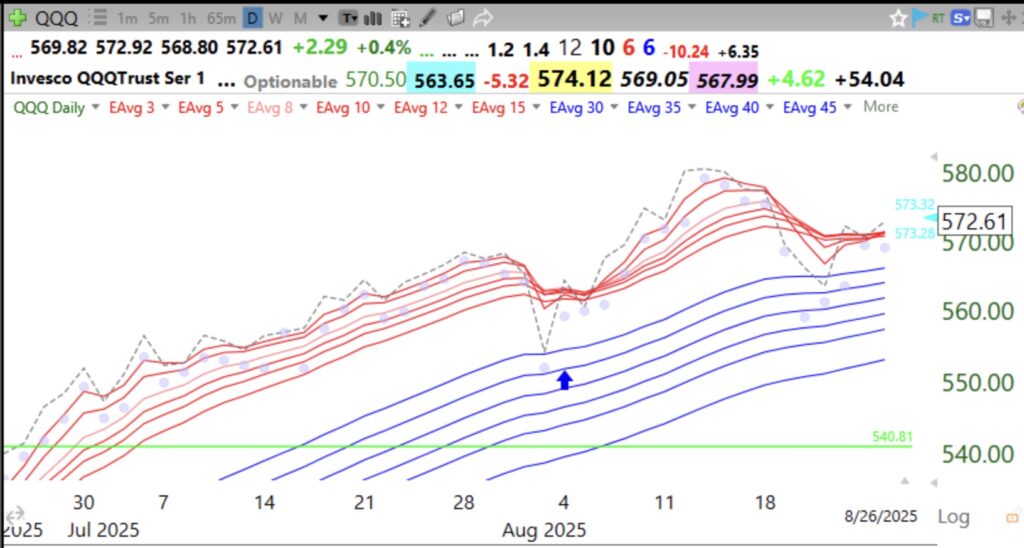

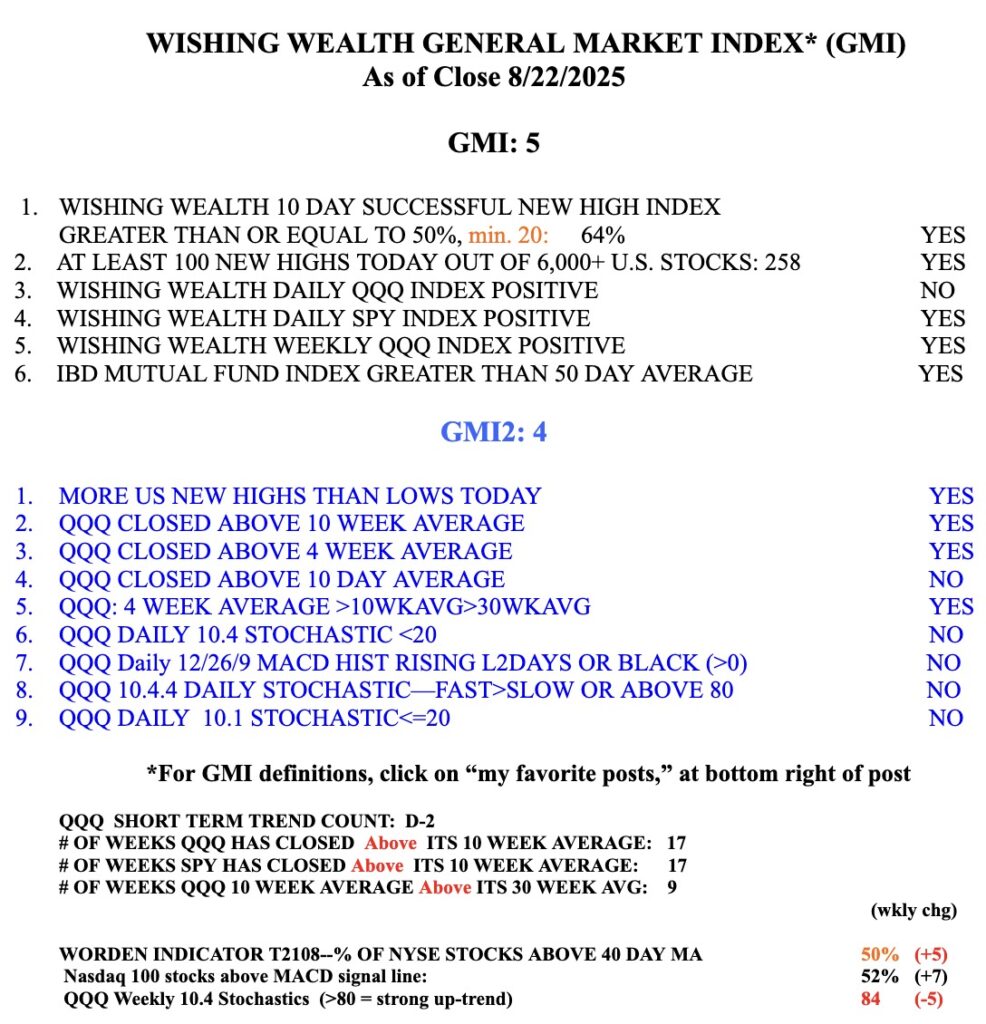

While I can think of many reasons why the market will not remain bullish now, I am ignoring them and following my rules. We finished day 4 of the new QQQ short term up-trend and Friday will reach Day 5. I have repeatedly found that if I just held TQQQ from early in a new QQQ short term up-trend I would have outperformed most individual stocks. So I bought a little TQQQ on Day 1 and am slowly adding more. I may buy more again on Friday when it will likely reach Day 5. One has to move quickly with the leveraged ETFs and limit losses, however. See Les Masonson’s excellent recently published book on the topic.

I am also holding some GOOGL. GOOGL had a recent GLB and is holding the green line (207.05). How nice to ride such a leader, for now. See the weekly chart below. Note GOOGL has been riding above its rising 4 wk avg (pink dotted line) for 10 straight weeks. This is the pattern of an advancing stock. See also its daily chart. If GOOGL CLOSES back below the green line, it is a failed GLB and I will exit immediately.

ScreenshotScreenshot