The QQQ (and the SPY and DIA) are following a pattern similar to the one formed in December and January. The market rises and then enters a downward sloping channel of consolidation. I have drawn in the channel lines in the daily chart of the QQQ below. There are three things I look for in this daily chart. First, I look for the QQQ to bounce back and forth between the channel lines until an up or down-side break-out. Second, I look at the Bollinger Bands to guide my interpretation. The QQQ often finds support at the lower daily 15.2 BB. And third, the stochastics (daily 10.4) provides further indication of a possible oversold bounce. I look at all 3 of these indicators to guide my trading. I sometimes trade the 3x leveraged bullish ETF, TQQQ, to ride the bounce up. I reduce risk by determining in advance a price which may signal that the bounce has failed and where I intend to sell out my position for a small loss. I find it much safer to trade a bounce off of support in an up-trending index or stock rather than buying break-outs. This is one of the primary techniques I teach my students at the university.

So what does this chart tell me now? (Click on chart to enlarge.) We are backing off of resistance at the top channel line. The decline has not yet reached oversold territory, however. The stochastics are at a relatively high 70 level and the QQQ remains well above the bottom BB and the channel line. I am waiting for these indicators to suggest a bounce from oversold. The index does not have to be oversold to signal a turn, however. The last bounce in February occurred with the stochastics around 38 (a bullish divergence) and just above the lower BB. While a turn at oversold levels is less risky for me, a turn at stronger levels can also signal the start of a nice move up. While the market can do anything, I suspect this decline will take us to oversold levels. The Worden T2108, at 51, is still high. T2108 fell to around 40 at the time of recent bounces.

The analysis above is very short term oriented. The weekly modified GMMA chart shows the QQQ remains in an RWB longer term up-trend.

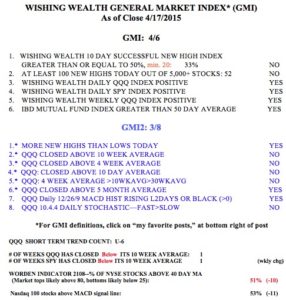

IBD calls the market up-trend under pressure. The GMI remains on a buy signal since January. However, both the QQQ and SPY have now closed below their critical 10 week averages. Caution is called for.

IBD calls the market up-trend under pressure. The GMI remains on a buy signal since January. However, both the QQQ and SPY have now closed below their critical 10 week averages. Caution is called for.