The vicious high volume break in the tech stock short term up-trend is a major sign of weakness. The GMI is down to +2, for the first time since the decline last November. This is not the time to be brave; I must conserve my capital. I will lighten up this week, move up my sell stops, and wait to see if the decline deepens. Given that the longer term up-trend remains intact, I will not go into cash in my conservative university pension funds.

General Market Index (GMI) table

NASDAQ 100 Index Still in Up-trend; QLD and TYH beat most NASDAQ 100 stocks again!

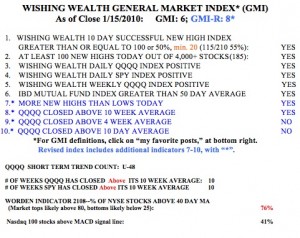

The GMI is still at 6 although the more sensitive GMI-R has declined to 8. Still, there were 185 new highs in my universe of 4,000 stocks on Friday.  The Worden T2108 Indicator is now at 76%, within neutral territory and down from the high of 84% last week. But only 41% of the Nasdaq 100 stocks had their MACD above their signal line, reflecting the weakness in tech stocks. Still, the SPY and QQQQ have closed above their 10 week averages for 10 weeks. During that time, the QQQQ increased +11%, QLD by +23% and TYH by +36%. The TYH beat all but 3 of the Nasdaq 100 stocks and QLD beat all but 12 of them. I repeatedly learn the virtue of just holding the QLD or TYH ETF’s rather than trying to find the few individual stocks that beat these amazing ultra ETF’s.

The Worden T2108 Indicator is now at 76%, within neutral territory and down from the high of 84% last week. But only 41% of the Nasdaq 100 stocks had their MACD above their signal line, reflecting the weakness in tech stocks. Still, the SPY and QQQQ have closed above their 10 week averages for 10 weeks. During that time, the QQQQ increased +11%, QLD by +23% and TYH by +36%. The TYH beat all but 3 of the Nasdaq 100 stocks and QLD beat all but 12 of them. I repeatedly learn the virtue of just holding the QLD or TYH ETF’s rather than trying to find the few individual stocks that beat these amazing ultra ETF’s.

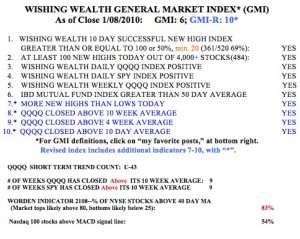

Up-trend continues; GMI strong but T2108 is at 83%

All of my indicators are still in up-trends, with the GMI at 6 and the GMI-R at 10. The Worden T2108 indicator is at 83%, not far from the highest levels that it typically gets to, around 90%. I continue to hold QLD and a few other individual stocks. Meanwhile, the QQQQ has completed the 43rd day of its short term up-trend and has been above its key 10 week average for 9 straight weeks. No one knows when an up-trend will end. We must wait for the critical technical signals. A trend follower must always get out after the top, after the down-trend has revealed itself. The key is to ride the elevator up and exit near the top floor, before it drops to the basement.

Meanwhile, the QQQQ has completed the 43rd day of its short term up-trend and has been above its key 10 week average for 9 straight weeks. No one knows when an up-trend will end. We must wait for the critical technical signals. A trend follower must always get out after the top, after the down-trend has revealed itself. The key is to ride the elevator up and exit near the top floor, before it drops to the basement.