Wednesday was the 74th day of the current QQQ short term up-trend and is inconsistent with the GMI sell signal flashed on Tuesday. IBD still says the market is in a correction. It will take a few more days to discern the market’s true trend. I remain in cash in my trading accounts and on the sidelines. I still own a few put options on GLD. It is of concern that AAPL did not rise with the market on Wednesday. It has declined three days in a row. When the leaders do not charge ahead with the market, it can be a warning sign.

GMI registers 2 again and flashes sell signal; in cash and short gold

The GMI buy signal from 12/23 has been ended. The GMI flashed a sell signal on Wednesday, as it closed <3 for two consecutive days. The QQQ rose 18% during the market advance since 12/23. I went to cash in my trading accounts on Wednesday but retained puts on GLD, which still appears to be in a Stage 4 decline. The QQQ short term up-trend is still intact, however, as it reached the 73rd day on Wednesday. The GMI and the QQQ short term trend count are different indicators of the market’s trend. I rely on both as an indication of the market’s behavior. The QQQ is sitting right on support. The short term trend indicator could turn negative this week with a few days of declines. I will be more confident of the GMI sell signal if the short term indicator also turns negative and lasts for 5 days.

I am therefore content to be on the sidelines in my trading accounts while this market digests earnings. I need to see evidence of a sustained up-trend to go long again. I remain fully invested in mutual funds in my longer term university pension account.

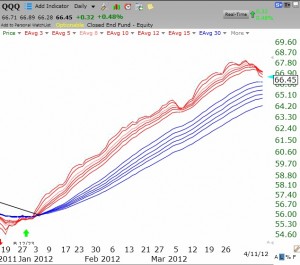

The SPY and DIA charts look much worse than the QQQ. This daily Guppy chart of the DIA shows that the short term averages (red lines) are turning down and crossing the longer term averages (blue) for the first time since last December. (Click on chart to enlarge.) A similar pattern is evident in the SPY, but not in the QQQ, and suggests to me a developing down-trend, at least in the larger cap stocks represented in the components of the DIA and SPY.

GMI falls to 2; Sell signal coming on Wednesday?

Another day with the GMI below 3 will trigger a GMI sell signal. The QQQ short term up-trend turned 72 days old on Tuesday and could end on Wednesday. I lightened up on long positions and am getting ready to go to cash in my trading account. I have not sold out my mutual funds in my university account, given that this still looks like a Stage 2 major up-trend. The Worden T2108 reached 21%, getting closer to an oversold level. Many declines have ended when the T2108 is below 20%.