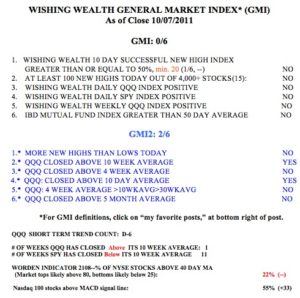

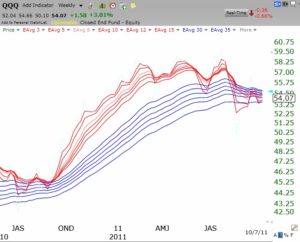

The GMI rose to 4 and I can now start to look at going long, but slowly. Tuesday was the first day of the new QQQ short term up-trend. There are just too many skeptics about this market. There are about 11% more bears than bulls in the Investors Intelligence poll and the market rarely plays to the majority. The 10.4.4 daily stochastics for the QQQ, DIA and SPY are all above 80%–overbought. This is the area where recent rallies have ended. So, I expect a retracement of the recent rise. The key to this market is whether the retracement takes back all of the recent gains or stops short and resumes the up-trend. If the rally resumes, I will have to get back into the market more quickly because I would expect a sharp rise. It is time to patiently wait to discern which way this market is going to go.

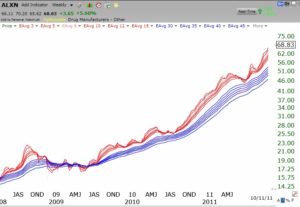

Meanwhile, ALXN hit another 52 week high on Tuesday. ALXN has a very nice chart as shown in this weekly GMMA chart. It has an RWB rocket stock pattern. Click on chart to enlarge.