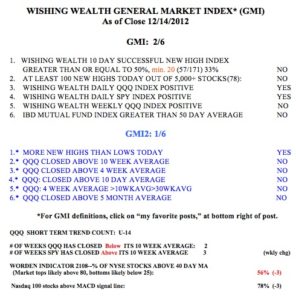

The GMI has declined to 2 and could signal a Sell if it remains below 3 on Monday. I am ready to lighten up my position in TQQQ. In contrast to the QQQ, the SPY and DIA remain stronger. AAPL may be major reason why the QQQ has weakened, but it is noteworthy that the IBD mutual fund index is now below it 50 day average. This is a component monitored in the GMI. It means that the growth mutual funds tracked by the IBD index are not doing well. If they cannot do well, neither can I.

(Mongoose, Gilead, Bruno, I will miss your astute comments and hope you are reading my blog from heaven.)