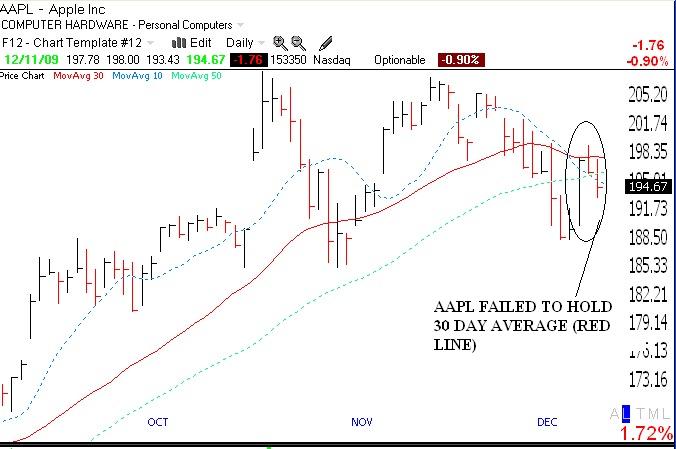

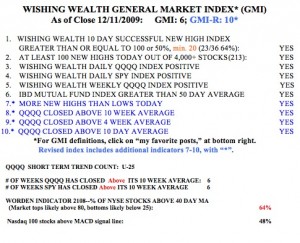

I am still concerned that AAPL (and NFLX) is showing technical weakness. On Friday, the stock could not hold its 30 day average and its 10 day average (blue dotted line) remains below its 30 day average.  See the daily chart for AAPL below. While AAPL could always break above its 30 day this week, until it does, it may be flashing a short term down-trend. Another stock that I am short is EMS, which may also be flashing a sell signal. EMS may have formed a head and shoulders top. Nevertheless, the GMI and GMI-R are at their maximum values. So the QQQQ (Nasdaq 100 ETF) is still in short and longer term up-trends. The Worden T2108 Indicator is at 65%, in neutral territory. The daily stochastics for the QQQQ are flat and in neutral territory. So I continue to ride QLD but remain cautious, with the weakness in AAPL and NFLX.

See the daily chart for AAPL below. While AAPL could always break above its 30 day this week, until it does, it may be flashing a short term down-trend. Another stock that I am short is EMS, which may also be flashing a sell signal. EMS may have formed a head and shoulders top. Nevertheless, the GMI and GMI-R are at their maximum values. So the QQQQ (Nasdaq 100 ETF) is still in short and longer term up-trends. The Worden T2108 Indicator is at 65%, in neutral territory. The daily stochastics for the QQQQ are flat and in neutral territory. So I continue to ride QLD but remain cautious, with the weakness in AAPL and NFLX.

Month: December 2009

AAPL at critical point today

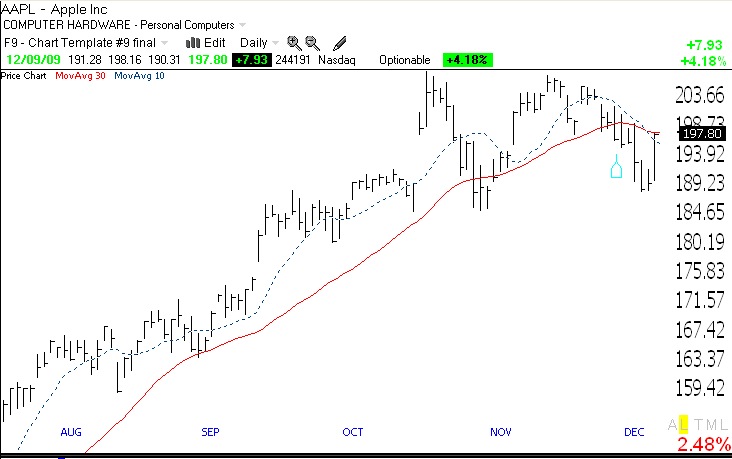

Since I posted a few days ago a Guppy chart showing short term weakness in AAPL, the stock declined and then bounced on Wednesday. The stock did reach a very low level on its daily stochastics (10,4,4) indicator and a reversal of the short term down-trend is still possible. However, I am waiting for a close back above its critical 30 day average to go long on the stock. The daily chart below shows that the 30 day average (in red) is curving down and for the first time since the rise began last March the 10 day average (dotted line) is below its 30 day average. Both of these short term indicators are bearish. A close above 198.11 today would turn me bullish on the stock. A bounce down off of the 30 day average and a close below 198.11 would make me very cautious on the stock. If the stock starts down today, it could have formed a short term double top, having met strong resistance around 208. If/when it closes above 208-209, the up-trend will have likely resumed. Remember though, AAPL remains in a longer term Stage 2 weekly up-trend.

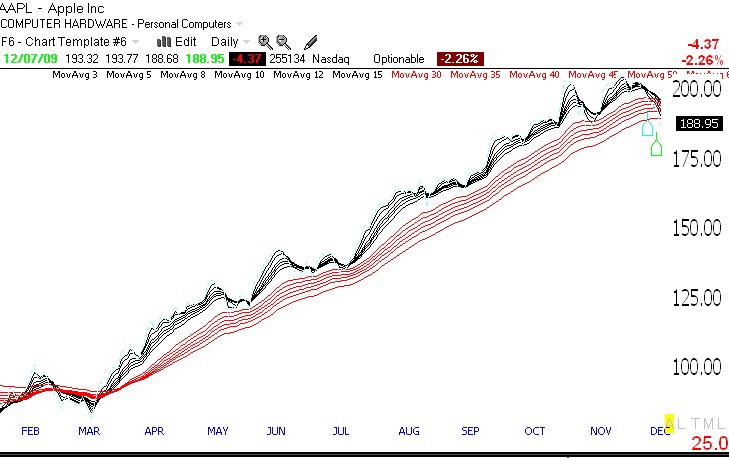

AAPL daily Guppy chart looks ominous short term

While still in a longer term up-trend, AAPL has closed below its critical 10 week average for the first time since its rise began last March. (Daily volume has also tended to spike on the down days.) Since March, AAPL has more than doubled. The longer term trend remains intact, but this daily Guppy chart shows that the short term averages (in black) are now heading down and penetrating the longer term averages (red). I closed out the puts I sold on AAPL and am now waiting on the sidelines to see if the down-trend deepens or reverses. Note that every long term decline must first begin with a short term decline.