I thought you might like to see why we may be at the beginning of a short term decline in the tech stocks. TYH is the 3X ultra long tech ETF and it appears to be in a rising channel. TYH recently hit the top of the channel, which has been followed by a decline four times in the recent past. Nevertheless, the tech stocks remain in a longer term up-trend. The question is whether to sell a little now, or just hold on to see if the channel holds. Regardless, it seems to me that this may not be the time to take on new tech positions. Much better to buy closer to the bottom of the channel, if it holds.

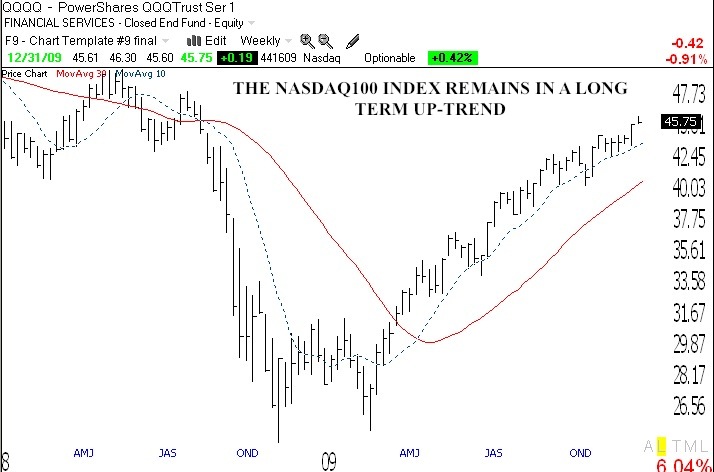

But the long term Stage 2 (a la Weinstein, see his book to lower right) up-trend remains intact. Note, however, that the QQQQ does appear to be a little extended on this weekly chart too, having closed at the bottom of its last 5-day range.

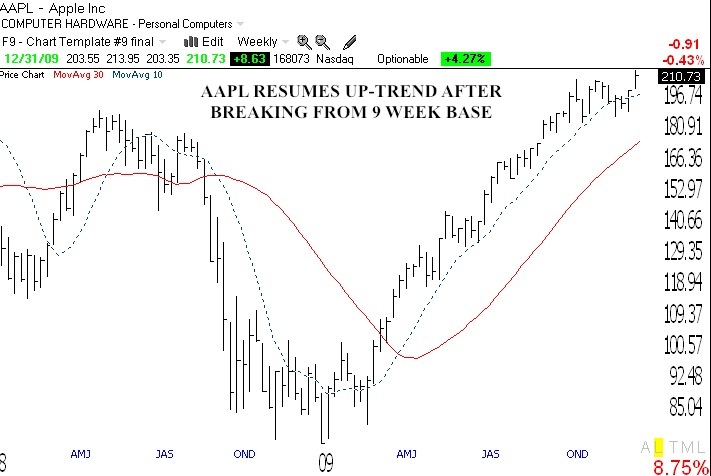

Even as AAPL breaks from base. (All charts built using Worden TC2007)

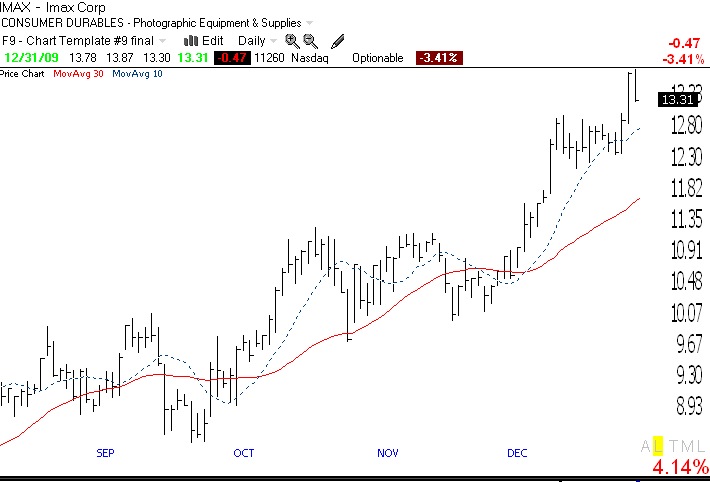

Note on this daily chart that IMAX broke out to an all time high last week (on huge volume). My extraordinary stock picking friend, Judy, has been talking about IMAX since the stock was around $2. She of course bought it way back back then. It takes a while for the rest of us to catch up to Judy. She says the technical innovations in the recent 3D IMAX release, Avatar, is as big as when movies went from black and white to color. So, I own IMAX and am watching the story unfold.