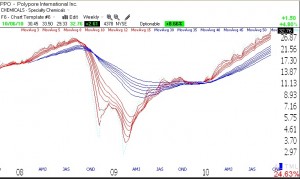

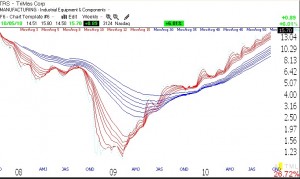

The QQQQ completed the 22nd day of its short term up-tend on Wednesday. Nevertheless, there were severe cracks in some high fliers I have been following: FFIV, CTXS, APKT, NTAP, BIDU. This is a good time to have sell stops in place so that one can retain much of the gains from the September rally. Another RWB rocket stock worth researching: PPO

Month: October 2010

GMI declines to 5, GMI-R to 7.

The short term trend of the market continues to weaken. The T2108 is at 82%, still near overbought territory. Only 53% of the Nasdaq 100 stocks closed with their MACD above its signal line, down from 95% 10 days ago. I have reduced some positions in my trading IRA as I wait for the next rally attempt. The QQQQ short term up-trend reached 20 days on Monday. I am waiting to see if options expiration or earnings release can drive the market higher.