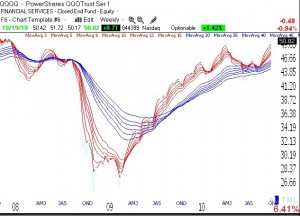

While the GMI fell to 4 (of 6) and the GMI-R, to 8 (of 10), the QQQQ remains in long and short term up-trends. See the weekly GMMA chart of the QQQQ below. All short term averages (red) are above the longer term averages (blue). The T2108 has fallen to 77%, now out of overbought territory, but could be signaling a move down. I am a little defensive and will not add to positions for now. We must keep an eye on the tech leaders (GOOG, AAPL) to gauge the health of the market. Both of these stocks remain in up-trends. The election results and the year end rally are possible catalysts for a continuation of the up-trend.

Month: October 2010

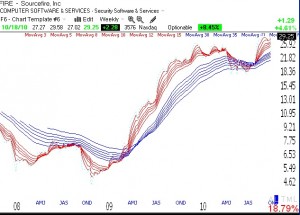

QQQQ short term up-trend reaches 30th day; tech leaders sputter; RWB stock: FIRE

The sell off in tech stocks Monday night after earnings were released is a warning sign, but all of my indicators remain positive and the up-trends are intact. Still, as a trend trader I rarely get out at the top, only after the trend has reversed. It will be important to see where support comes in for the leaders. A stock that came up in my scan Monday night is FIRE. It may be breaking from a base and starting a new RWB run, as this weekly chart shows (click on to enlarge). It also has a promising monthly chart. I have not researched it yet, but if I bought FIRE, my sell stop would be near support, around 26.89.

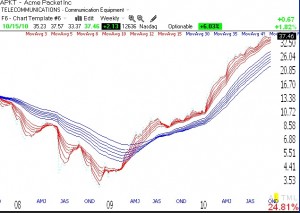

Amazing action in GOOG and AAPL lifts my accounts; RWB stock: APKT

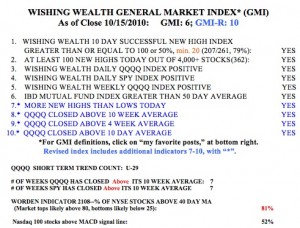

I am amazed at how effective the GMI and GMI-R have been for keeping me on the right side of the market. While the media pundits were talking about a possible double dip recession and a head and shoulder’s top on the indexes, the GMI went positive with a reading of 4 on September 3rd and has registered 5 or 6 since then. This time when the buy signal occurred I bought QLD (the 2X ultra long QQQQ index) and have seen it rise nicely, capturing the strength in the technology stocks. I also bought options on AAPL and more recently on GOOG and have seen one of my accounts increase more than 100%. In a prior post I showed you how to buy expensive stocks like AAPL with only 10% down using deep in the money call options. I bought deep in the money calls on AAPL recently and the trade worked out well. Check out my earlier post………

So the GMI remains at 6 (of 6) and the more sensitive GMI-R at 10 (of 10).  The QQQQ short term up-trend completed its 29th day on Friday and the QQQQ and SPY have closed above their critical 10 week averages for 7 straight weeks. The T2108 has weakened a little to 81%, still near overbought territory. More than one half (52%) of the Nasdaq 100 stocks closed with their MACD above its signal line, a sign of short term strength. So, I remain 100% long in my university pension and my margin account. My IRA is substantially invested in long positions in stocks or options…

The QQQQ short term up-trend completed its 29th day on Friday and the QQQQ and SPY have closed above their critical 10 week averages for 7 straight weeks. The T2108 has weakened a little to 81%, still near overbought territory. More than one half (52%) of the Nasdaq 100 stocks closed with their MACD above its signal line, a sign of short term strength. So, I remain 100% long in my university pension and my margin account. My IRA is substantially invested in long positions in stocks or options…

I ran my favorite scan of stocks in my IBD100/NEW America watch list, looking for stocks that were in up-trends and bouncing up off of support. One of the stocks that came up was APKT. The weekly chart below (click on to enlarge) shows that APKT is a RWB stock. I like it as long as it remains above $36.