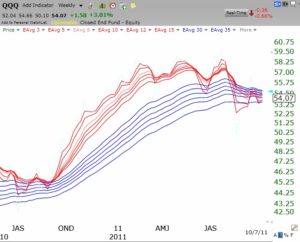

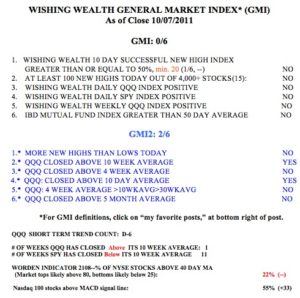

The QQQ short term down-trend reached its 6th day on Friday. GMI remains at zero, but shorter term GMI2 shows a little strength, at 2.  Meanwhile, the weekly GMMA chart of the QQQ shows a level, basing? pattern, for now. Click on chart to enlarge. I remain in cash until the GMI rises above 3.

Meanwhile, the weekly GMMA chart of the QQQ shows a level, basing? pattern, for now. Click on chart to enlarge. I remain in cash until the GMI rises above 3.