I have written several times that we might get a retracement of the current rise, because the indexes had stochastics in overbought territory. The daily QQQ 10.4 stochastic (red line) is about 95 and about to cross below the longer average (blue line).  We may get that retracement now. But the longer term trend of the QQQ appears to be reversing to the up side and this may be the last chance to get into the market before the advance strengthens. I bought more mutual fund shares in my university pension on Monday.

We may get that retracement now. But the longer term trend of the QQQ appears to be reversing to the up side and this may be the last chance to get into the market before the advance strengthens. I bought more mutual fund shares in my university pension on Monday.

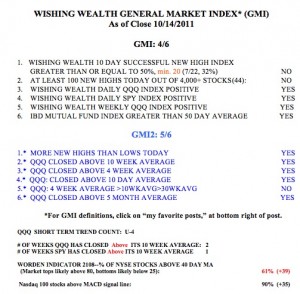

The QQQ short term up-trend completed day 5 on Monday. Once a new short term trend reaches 5 days, it often continues for a longer period. We still have very few stocks hitting new 52 week highs, however, so betting on stocks at new highs is not a winning strategy yet. Once we get 100 or more new daily highs I can begin to buy strong growth stocks again. At that time the GMI should reach 5.