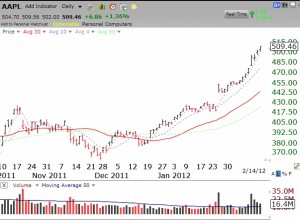

AAPL had a high volume reversal on Wednesday and the Worden T2108 indicator started to decline. Perhaps we will now get the post earnings release lull and consolidation? Given the strong up-trend in place, I would be surprised to see a major decline. In Leferve’s classic book (listed to lower right) about the greatest stock market speculator ever, Jesse Livermore, is the following wise quote:

“The trend has been established before the news is published, and in bull markets bear items are ignored and bull news exaggerated, and vice versa.”

I would suggest that in the current bull move, the financial events in Europe will not have as great a negative impact as they had last year when the market was often in a decline phase with the GMI below 3.