The GMI and GMI-2 are each 2 (of 6). With Thursday’s rebound, the new short term down-trend may not hold. I am laregly out of the market waiting for a significant trend to develop. IBD changed its outlook again and now sees the market in a confirmed up-trend. This has been a very difficult market to figure out. Meanwhile note this monthly green line chart of IOC hitting a new high out of a two year base on Thursday. It reports earnings soon and has a very high short interest. I am researching it. Will it hold?

Month: July 2012

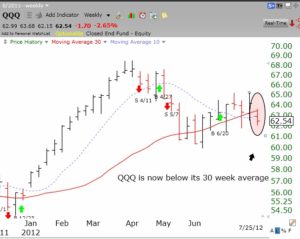

New QQQ short term down-trend; GMI flashes “sell” signal

The QQQ short term up-trend has ended after 26 days. I am most confident of a change in short term trend once it has persisted for 5 days. The GMI has also flashed a Sell signal and IBD sees the market in a correction. So I am mainly in cash with a small position in SQQQ, the 3X leveraged inverse QQQ ETF. It is designed to rise 3X as much as the QQQ declines. Note this weekly chart of the QQQ shows that this index ETF has closed below its 30 week average (red line). The 10 week average (blue dotted line) is also below the 30 week average, another sign of weakness. Click on chart to enlarge. It remains to be seen whether the QQQ will quickly retake its 30 week average as it has several times in the past 10 weeks. But it is better for me and my money to be safe than sorry.

QQQ short term up-trend in jeopardy; mainly in cash

I closed out most long positions on Tuesday and took up some small short positions in SPY and QQQ. The GMI declined to 2 (of 6). Another weak day will likely yield a GMI sell signal at Wednesday’s close. The QQQ is firmly below its 30 week average and now its 30 day average. Many of the leaders I watch have hit air pockets and fallen quickly, including CMG, ISRG, TDG, NVR, and now maybe AAPL. This is the time for me to move to the sidelines in my trading accounts except for a few shorts.

My university pension remains invested in mutual funds for now. If the 30 week averages of the indexes should curve down into a Stage 4 decline, I will begin transferring out of mutual funds and into money market funds. It is premature for me to do that now.