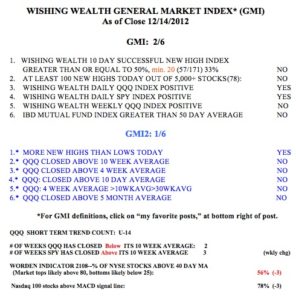

The GMI rose to 3 and averted a Sell signal. Meanwhile the QQQ short term up-trend extended itself to its 15th day. It looks like the QQQ successfully tested support on Monday. I am adding again to my position in TQQQ, the leveraged 3X bullish QQQ ETF. Because I trade in my IRA, I can go in and out of securities without worrying about taxes and wash sales rules. It is the best way to trade. So I am cautiously bullish and long.

I recently conducted a webinar for the Houston TeleChart (TC2000) Users Group. The Worden staff were nice enough to moderate the webinar and tape it for free public distribution. If you would like to view it, please click on this link and let me know how you like it. It lasts over 2 hours and provides a good overview of my current trading strategy.