As many of my readers know, I began this blog after watching many of my friends be misled by the media into losing their savings in the 2000-2002 market decline. I had safely sat out that decline in cash and did so again in 2008. (I did get back in after each of these declines.) I am a chicken and get out of the market when my indicators signal a possible significant decline. If I am wrong, I can always re-invest my money. Unfortunately, the financial press maintains that one cannot time the market and should ride the market down. While that was never palatable to me, it is even less feasible at a time when many boomers are nearing retirement and dependent upon their 401 (K) for their imminent retirement. With the 2000 and 2008 declines in their rear view mirrors, I suspect that most boomers who rode the market up since 2009 are going to flee at the first signs of trouble. Thus, I expect a steep decline once one begins. I do not expect a 2008 type decline, but with the Fed starting to raise rates, boomers are going to flee the risky equity markets for the safety of bonds and savings accounts as soon as their yields climb out of the basement.

You also know that I do not like to marry an interesting story or possible scenario for the market. None of the events I mentioned above may take place. But I am always vigilant for the first signs of a possible significant decline. And the market’s action the past few weeks cause me to begin to pull back from this market, even in my 401 (K) accounts where I am limited from making many trades in and out of the market. (Most of my investments are in tax deferred accounts where sales will not trigger a taxable event.)

We are in the seasonal “Sell in May” period when historically, the market has experienced smaller gains. Second, after earnings have come out, what will propel the market higher during the summer? Too many of the market’s leaders have fallen. And with the Fed tapering on QE, interest rates will likely rise sooner than later. And most important to me, Friday’s failure to get through an important area of resistance was a severe sign of weakness in this market. The QQQ, at 86.19, is riding just above its critical 30 week average (85.93). The 4 week average is already below the 30 week average, and declining. These are all signs of weakness. If the QQQ closes back below its 30 week average, I will begin to move my 401 (K) money from mutual funds to money market funds. I will do it in stages, maybe 25% at a time. If the 30 week average then starts to decline, I will move towards 100% invested in money market funds. I am merely telling you what I am doing, and not making any recommendations. Each person must act in the market consistent with their own time horizons, trading strategy and tolerance for risk. Last week I bought an option on QID (2X leveraged bear QQQ ETF) in my most speculative trading account. It would be nice to believe that the recent steep declines in the market leaders is healthy and that people are now merely rotating into safer sectors. But I do not believe in fairy tales and do not think the market operates that way. The stocks that captured investors’ imaginations in the bull rally are being decimated and that typically happens before the bear gets around to the less attractive stocks.

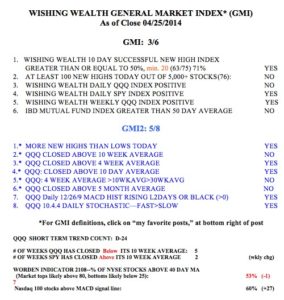

With all that said, is it not surprising that the GMI is on a Buy signal? This Buy signal has occurred in the face of a short term down-trend in the QQQ, now in its 24th day. This is a rare divergence. The QQQ came close last week to beginning a new short term up-trend, but failed. This failure was a significant event to me. It could still turn up next week, but right now I am making a small bet on a continuation of this down-trend. IBD also still sees the market in a correction.