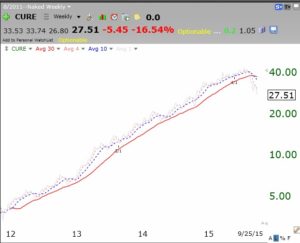

Nobody knows when this market will find a bottom. Note in this “naked” weekly chart of the QQQ, the 4wkavg(red dotted)<10wkavg(blue dotted)<30wkavg (solid red line). This is my primary definition of a “submarine” pattern. It shows a stock or ETF in a significant down-trend. I am in cash in both my university pension and all trading accounts. There is so much time to be invested when the indexes are in a rising “rocket” pattern. Note this was the case from July 2014 until recently, when the blue dotted line was rising above its rising red line. When the 4 and 10 lines move back above the red line, I will begin to look for long positions.

For the past 4 years one could ride the health care stocks in the 3X bullish ETF, CURE. For the first time since 2012, CURE’s 10 week average is now below its 30 week average. The leaders are starting to turn down……

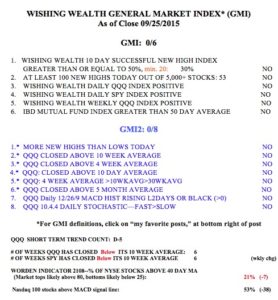

The GMI and GMI-2 are both registering 0.

Hi Dr Wish,

I really appreciate your blog. You give a unique perspective that I find very useful. I’m very impressed by your conviction to this downturn. I know that you’re very hesitant to go to all cash in your pension fund. I’ve tried to make some sense of this downturn. I looked back to the Jul 2007 and Jul 2011 downturns. The post-crash-volatility lasted for about 53 and 57 (calendar) days respectively. 53 days from 8/24/2015 would be 10/16/15. I’m wondering if the market may end the volatility on, or slightly subsequent to, that date? And if so, will the bull market resume, or will the next bear be thus confirmed? I, for one, will be very curious to see what happens. Thanks again for all of your good work!

Thank you Dr. Wish, for the light you shine on the twisting path the market takes.

Checking your site has become my early AM need-to-do