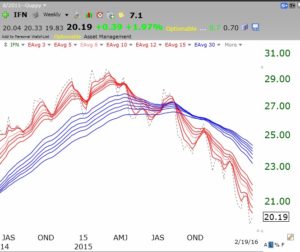

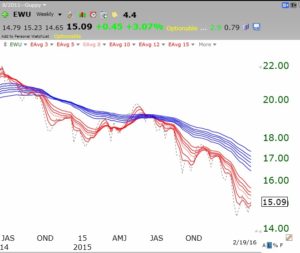

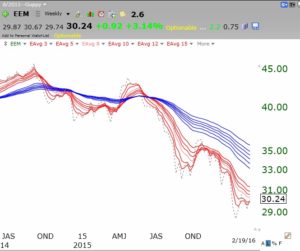

I presented a workshop for three hours yesterday to the DC metro AAII meeting, about 80 wonderful attendees. I taught them how I use modified GMMA charts to determine the general market’s and an individual stock’s major price trends. I then showed them that the QQQ and SPY were in BWR (longer term blue moving averages above shorter term red moving averages with a white space between them) down-trends. I did not show them my watchlist of 38 index ETFs from around the world. All but one, perhaps Ireland (where US companies are moving their corporate homes), are in fully developed BWR down-trends. Here are just a few:

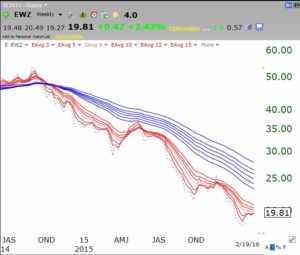

Brazil:

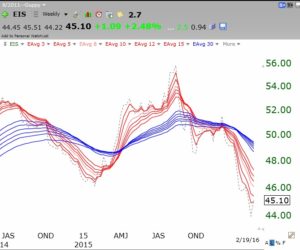

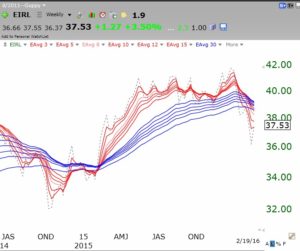

Ireland is the strongest of all, but a budding down-trend now:

Ireland is the strongest of all, but a budding down-trend now:

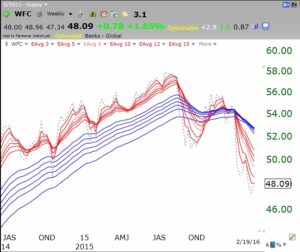

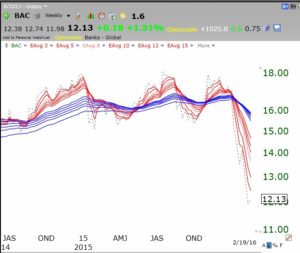

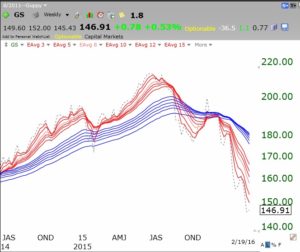

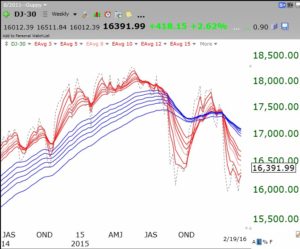

I could have shown you the others, but you can trust me that 37 of 38 world market ETFs I looked at are in solid BWR down-trends. Are we scared yet? The last time I saw anything like this was in 2007 when all of the bank stocks were in BWR down-trends. How are the banks doing now?

I could have shown you the others, but you can trust me that 37 of 38 world market ETFs I looked at are in solid BWR down-trends. Are we scared yet? The last time I saw anything like this was in 2007 when all of the bank stocks were in BWR down-trends. How are the banks doing now?

Bank of America, BAC:

Citicorp, C:

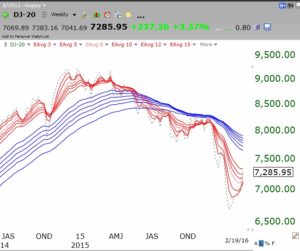

Are the Dow Jones Transports turning around as some pundits have opined?

Are the Dow Jones Transports turning around as some pundits have opined?

The GMI remains on a Sell signal and I am mainly in cash. Plenty of time to get back in later once the market has turned up. When will that occur and from what level? Nobody knows (but don’t hold your breath)….. For some insight, go to the movies and see The Big Short.

i traveled 300 miles to see u at the workshop in DC.

Was well worth the trip.

Great info was presented

Thank you for your kind words. I enjoyed meeting the attendees and hope all walked away with something of value to them.

Great site and information. Can I get access to the presentation.

Dr. Wish

What are the modified GMMA charts and how can I learn to use them?

@ Rory, Here is a link to a GMMA how-to video. It was done using TC2000 but you can us it as a reference for any charting software that allows you to plot EMAs (or SMAs): http://www.cesar.umd.edu/h348m/Videos/CreatingGuppyChart.mov

Looking at the GMMA chart, you would think it’s “obvious” that it lets you identify when to exit and enter. But how does it do in reality, with actionable signals?

Let’s apply some quantitative rules: Sell when the short EMAs are below the long EMAs; but when the short EMAs are above the long.

On the S&P 500 since 1950, starting with $10k:

GMMA: CAGR 5.5%, Profit: $325k, Maxdd: -38%

Buy&Hold: CAGR: 7.4%, Profit: $11M, MaxDD: -57%

Now, which is the better system?

(should say “buy” above, not “but”)

@ ZZ, I am assuming when you say “buy” you mean “enter into a long position” and when you say “sell” you mean “exit that long position.” How does your analysis fare if, instead of waiting for all the short EMAs to go below the long ones, you exit when all the short EMAs cease being above the long ones, i.e. once the 3 week EMA drops below the 30 week EMA? Waiting for the 15 week to drop below the 60 week would be a long wait through declining prices. For the current decline, if you were trading SPY that would mean getting out around 8/21/16 rather than around 10/2/16.

(tried posting yesterday, but not showing up):

Two mistakes on what I had above.

1. B&H is $1.1M profit, not $11M (too many leading 1’s!)

2. GMMA is:

CAGR: 6.3%, Profit: $575k, MaxDD: -33%

(I think I was running on daily bars, not weekly)

Now …

Changing the rules as suggested: go to cash when the short EMAs dip

below the highest long EMA (so all red lines would be under the

highest blue line); Buy when the red lines are above the lowest blue:

CAGR: 7.2%, Profit: $980k, MaxDD: -29%

So that approach looks a lot better in comparison. You give up some

CAGR but get significantly lower drawdown. There is a little bit of whipsaw with this, as the rules can be overlapping in some cases (get a sell then buy immediately, so some fine-tuning of that would be needed).

wanted to add: imho this is the sort of thing you should do, if you are looking to use such strategies. Don’t take someone’s word for it, or make a conclusion by eyeballing a chart. I think that a number of things posted here do not hold up under scrutiny of actual testing.

Dr. Wish, could you teach a seminar here in Alexandria or Springfield in Northern Virginia?? (just below the beltway). I think there would be a large audience. People here just don’t like to drive up to DC due to traffic and parking difficulties.

Thanks, John. I would need someone to arrange the venue. Do you have an investment club or meet-up?