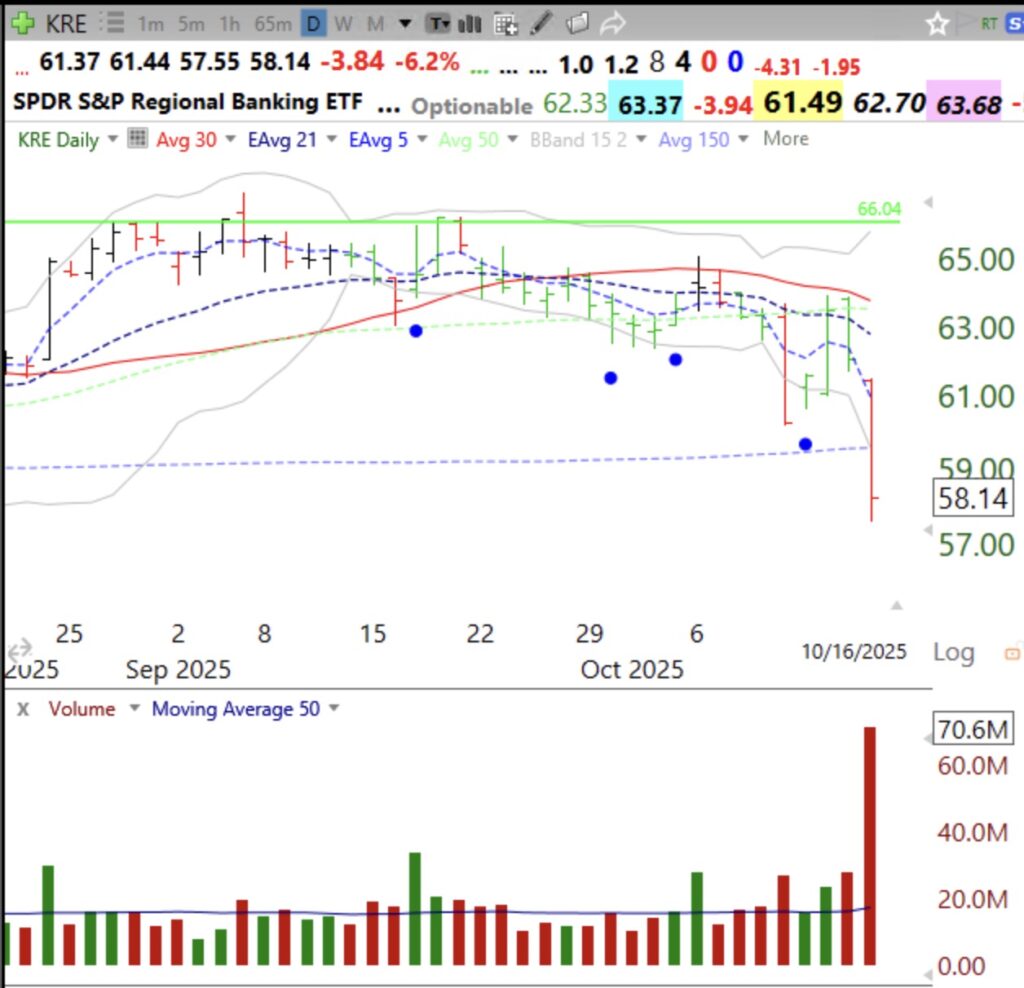

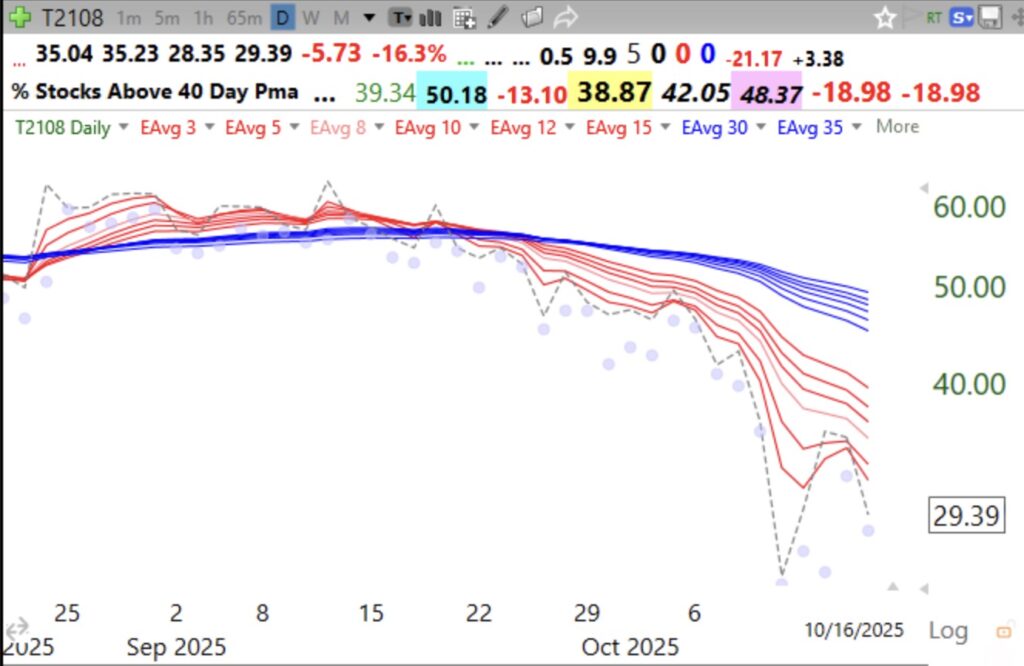

I was doing my normal nightly charting when I noticed big volume declines in bank stocks. KRE is just one banking ETF that is typical of many others. Look at the huge volume today. Individual banks are falling after reporting great earnings. It is also strange that T2108 is in a BWR down-trend. T2108 reflects the percentage of NYSE stocks that closed above their 40 day simple moving averages. And GLD keeps rising. Something is wrong. This market reminds me of 2008. I need to protect myself. I am a chicken (vegan).

From Investors Business Daily:

Regional banks fell sharply as Zions Bancorporation (ZION) reported a $50 million charge-off related to two of its borrowers facing legal actions. Zion stock tumbled 13%, while the SPDR S&P Regional Banking ETF (KRE) sank 6.2%, diving below its 200-day moving average.

Meanwhile, Western Alliance (WAL) said it filed a lawsuit in August against one of its borrowers, alleging fraud by the borrower. Shares plummeted nearly 11%.

Finally, investment banker Jefferies (JEF) plunged 10.6% in big volume amid worries over the company’s exposure to the recent collapse of auto-parts giant First Brands Group, whose products include Autolite sparks plugs.