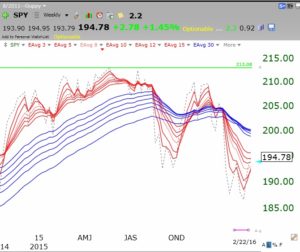

With Wednesday’s one day reversal, this market is beginning to show resilience. The GMI is back to 3 (of 6). Time to look for some emerging leaders.

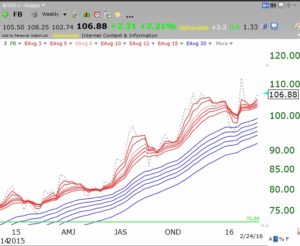

I like the way FB is behaving. It bounced on Wednesday. Also, any stock that can maintain its RWB up-trend during the past few months of market weakness merits attention. Note the stock closed Wednesday above all of its 12 moving averages. The gray dotted line shows each weekly close.

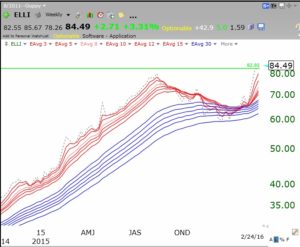

And ELLI is in the middle of a GLB to an all-time high.

And ELLI is in the middle of a GLB to an all-time high.

And may be showing resumption of its strong RWB up-trend.

And may be showing resumption of its strong RWB up-trend.