All Posts

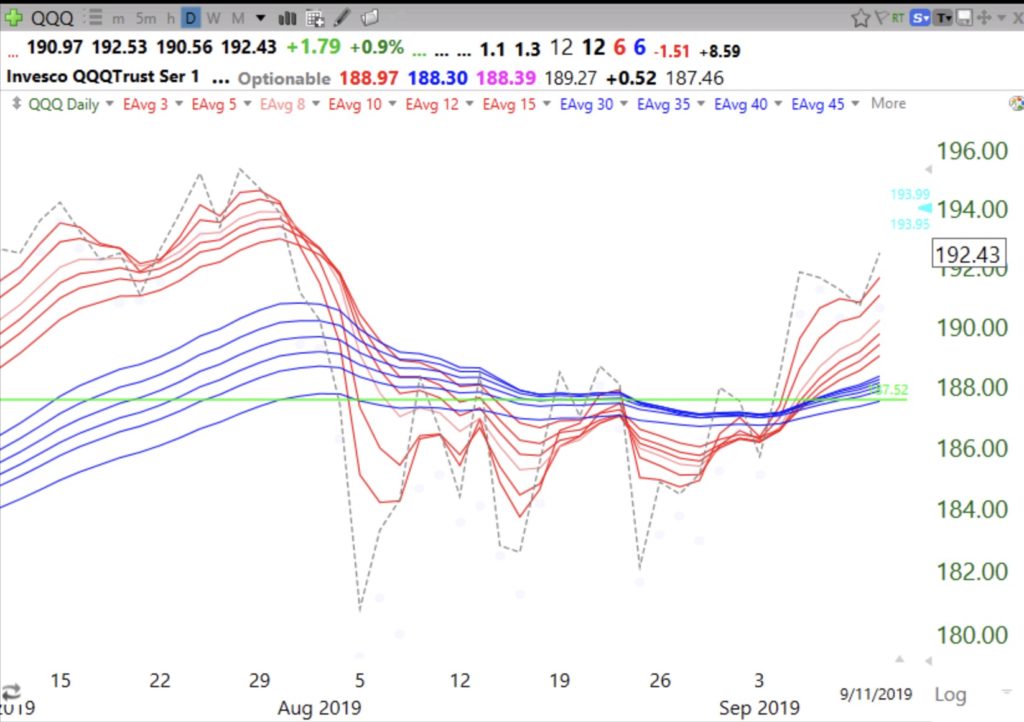

4th day of $QQQ short term up-trend but GLBs failing and GMI declines to 3 (of 6) GLB $CCMP

While growth stocks are getting hit, the market trend remains up. This is the time for me to have patience and to hold very small long positions, if any. Recent GLB ABG held up nicely on Tuesday. But OLED and SHAK were hit, along with CMG and MCD. What is ailing fast food stocks? GLB CCMP was strong on Tuesday.