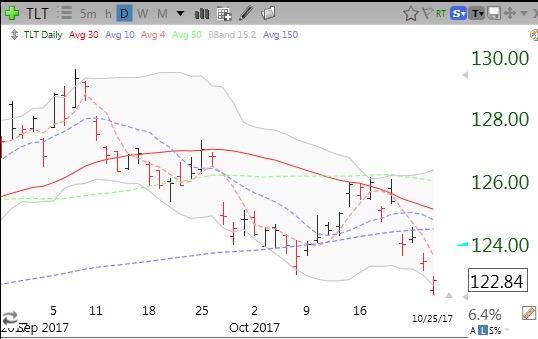

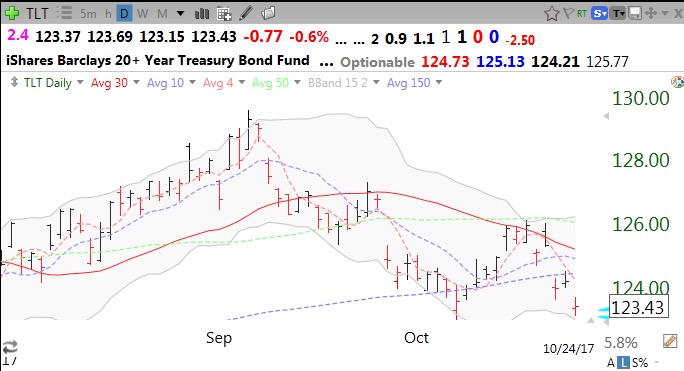

The put/call ratio is suggesting extreme bearishness among option traders. A reading larger than 1.1 generally leads to a bottom or at least a bounce. Much of the decline may be a reaction to falling bonds and higher interest rates, reflected in the continuing decline in TLT.