AAOI had a GLB with a gap up a few days ago and is holding up.

All Posts

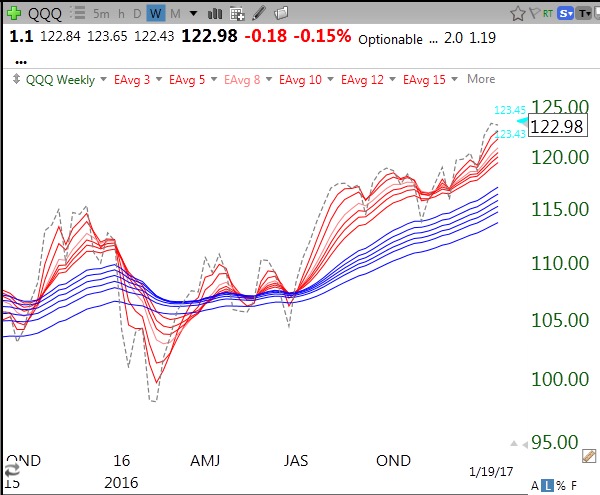

27th day of $QQQ short term up-trend; thank you Annapolis IBD meetup

I had a wonderful night making a presentation to the IBD meetup near Annapolis. Thank you to Vicki, Don and all of the gracious attendees. Let me know if you want to be put on the mailing list for their future meetings.