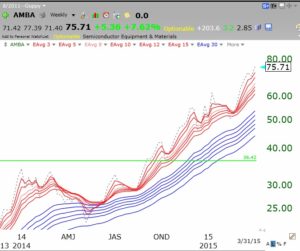

IBD says uptrend under pressure, but also that the put/call ratio was above 1 on Tuesday. Surprisingly, AMBA hit a new all-time high on Tuesday. It remains in a strong RWB up-trend and above its green line break-out. (I own some.)

Maybe funds wanted to dress up their end of quarter portfolios with this winner.