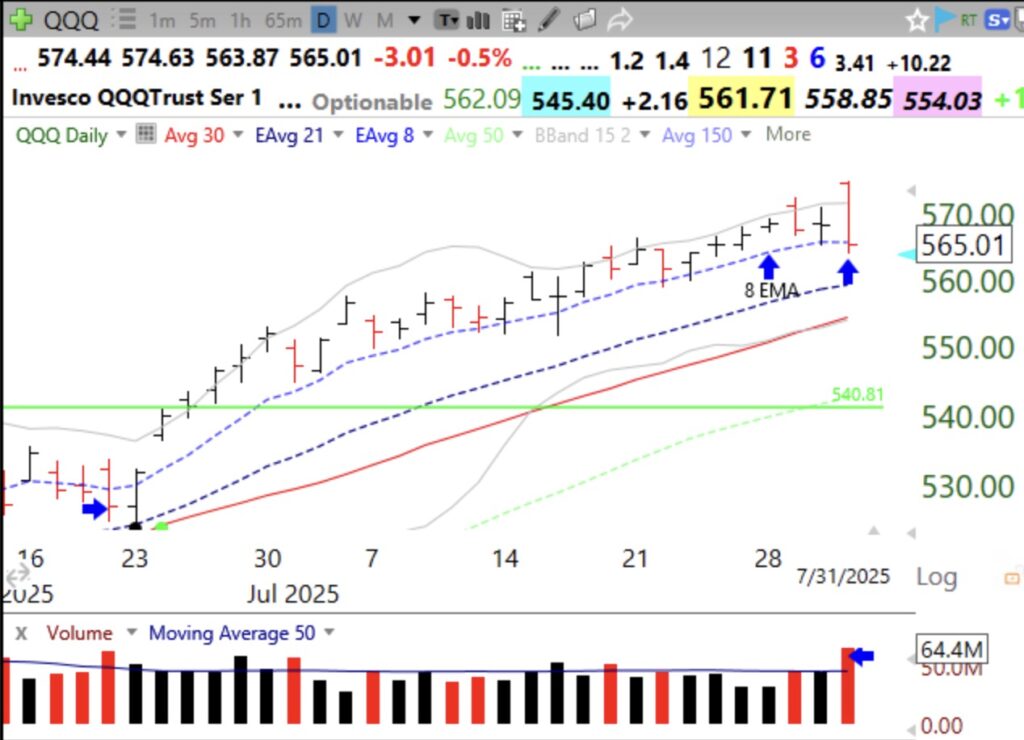

QQQ and SPY had large volume declines from ATHs, distribution days, on Thursday. Only 19 of the Nasdaq 100 stocks rose, the least since 14 on June 17. There were 80 new yearly lows among 6,217 US stocks, the most since 90 last April. I am not taking on more risk and may raise stops on Friday. Here is the daily chart with illustrative arrows for QQQ. The strong recent up-trends in these indexes may be ending.