I have learned over the years that I have more success trading strong up-trending stocks that are turning up after they have had a small decline than buying break-outs. I find that if I think a stock has bottomed and turned up, I know exactly where to get out if I am wrong–if the recent bottom does not hold. I therefore can take a position and if I am wrong can exit with a small loss–that is the secret of success in this business–many small losses and a few large gains. I use a 10.4.4 daily stochastics indicator to find stocks that may be resuming their up-trend. I look for stocks in an up-trend where the fast stochastics (10.4) has recently crossed above the slow 10.4.4 stochastics, or signal line. I like the cross to occur at an oversold stochastics value, below 50. My co-instructor, David, has written a small program in TC2000 for our students to use. It places a green dot on the chart on the day the cross-over occurs and places the dot at the 5 day low as a likely support level. I also add this logic to one of my TC2000 columns so I can quickly locate stocks in any watch list that have a green dot.

I have found the Green Dot strategy useful for trading the market indexes as well as individual stocks and ETFs. Green dots can occur in declining stocks but many of them will fail. I therefore first make sure the stock is in a strong up-trend using the RWB daily or Yellowband techniques (see blog glossary). Any stock I buy must also be trading above its rising 30 week average (Weinstein Stage II). A pattern of rising green dots is preferable, but not necessary. If I buy a green dot signal, I must exit quickly if the stock closes back below its green dot or the fast stochastic closes back below its signal line. If my trade set-up fails I exit.

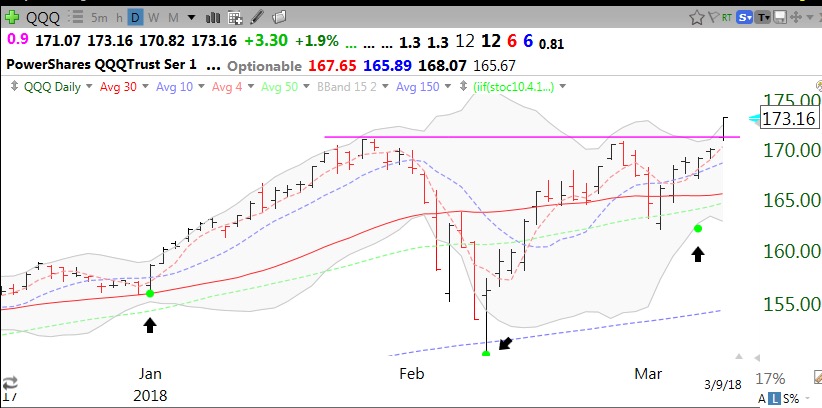

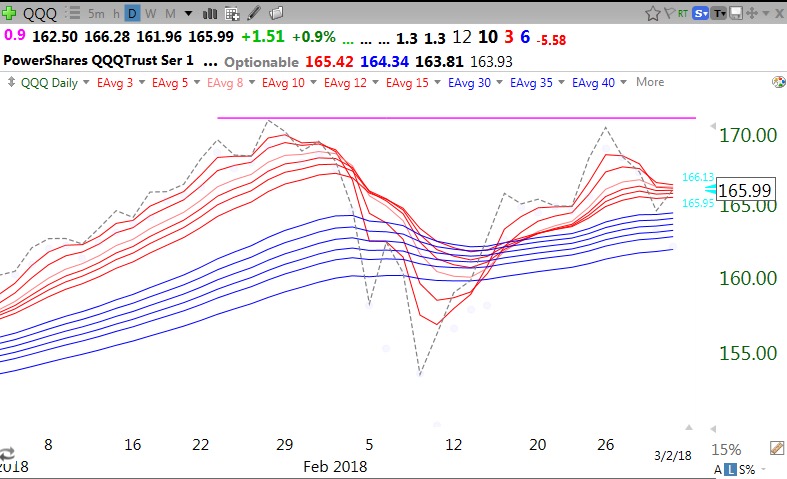

Here is a chart of the QQQ. The black arrows point out the green dots. The DIA and SPY also had green dots last week, foreshadowing the advances we had. (The QQQ pattern looks like a cup with handle break-out!)

Here is an example of how green dots have performed for $NKTR

And AAPL (note that some signals did not work out as well as others)

Green dots do not work well with a stock in a down-trend.

By the way, I try not to rely on a single indicator to make a decision. It is always best to look at other indicators (MACD, Bollinger Bands, moving averages) for confirmation of a buy signal. One should also plot the stochastics itself to see the level at which it is crossing. It takes 14 weeks to teach my undergraduate students these strategies! Let me know how the Green Dot strategy works for you…

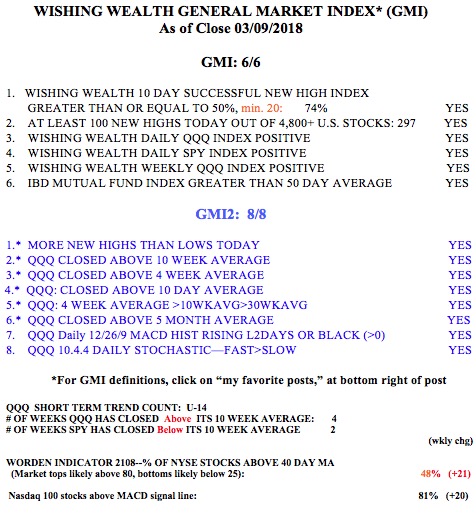

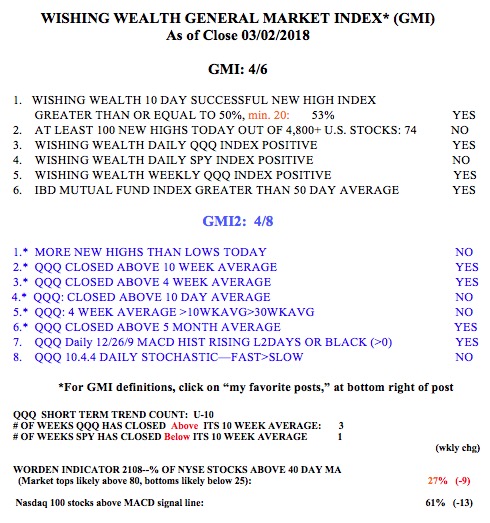

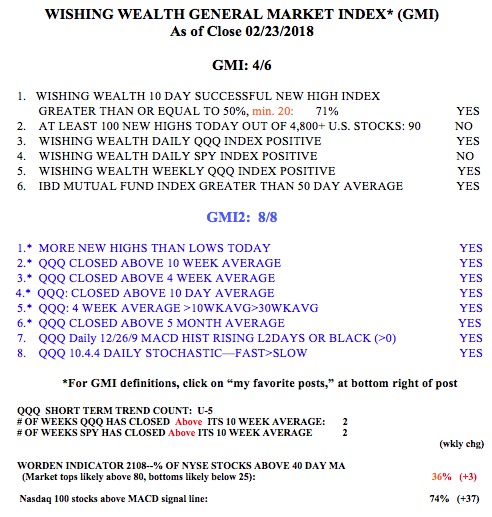

The GMI is a perfect 6 (of 6).