All 4 stocks are in up-trends with 10wkavg>30wkavg and above $150. These stocks traded below their bottom 15.2 daily Bollinger Bands anytime in the last 7 days and now are above their exponential 21 day averages. Check out their daily and weekly charts. If I bought any I would sell immediately after a likely close below that moving average or the lower Bollinger Band. As an example, here is the daily chart of ZTS. Note its GLB (green line break-out) in June and the black dot signals. An alternative place for a stop would be below the low of the bounce day, around 196.96. Remember new traders, you can buy one share and only risk about $5. You have to learn how to manage your losses.

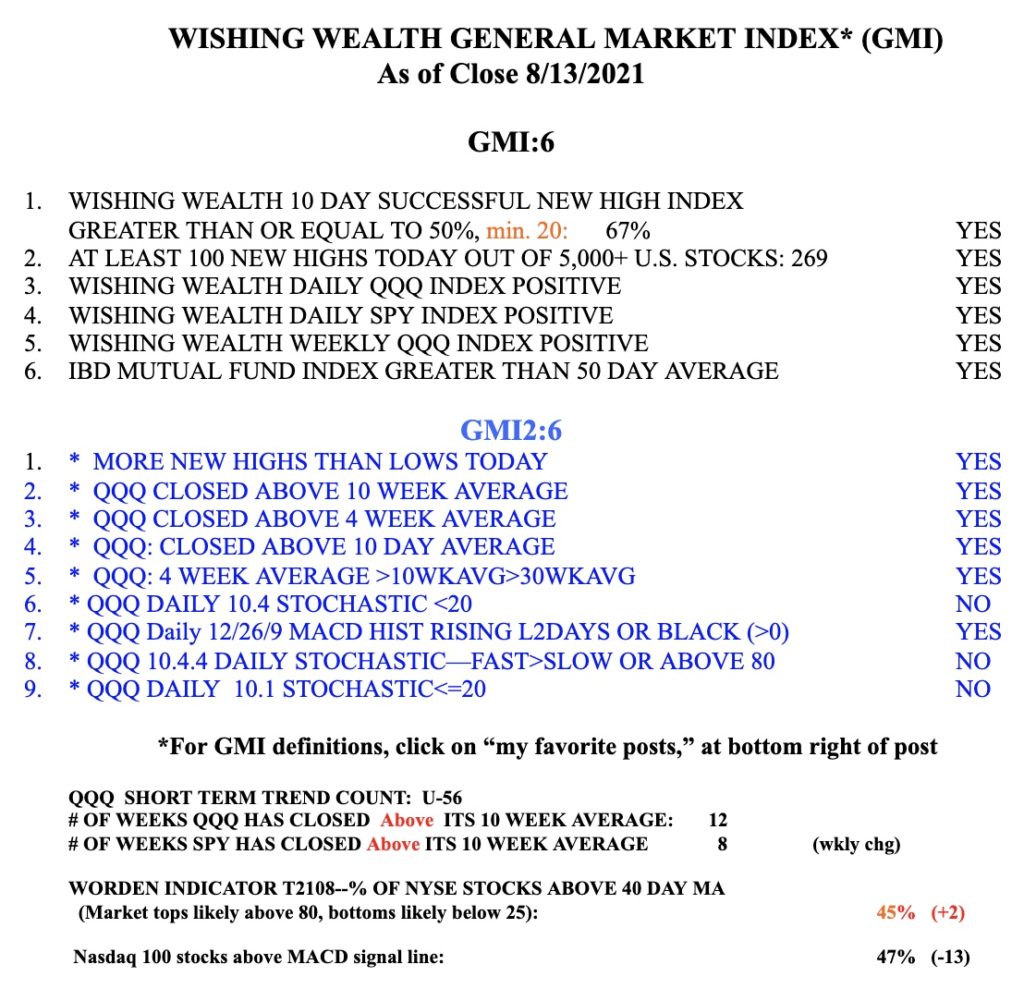

The GMI is at 6 (of 6). QQQ has closed above its 10 week average for 12 straight weeks. I still fear the coming month of September and remain very cautious.