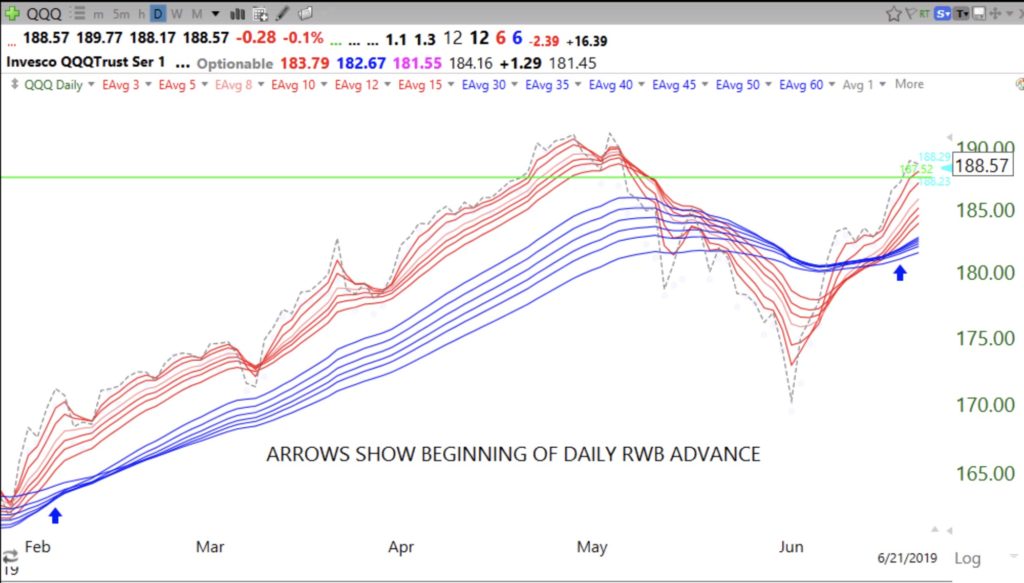

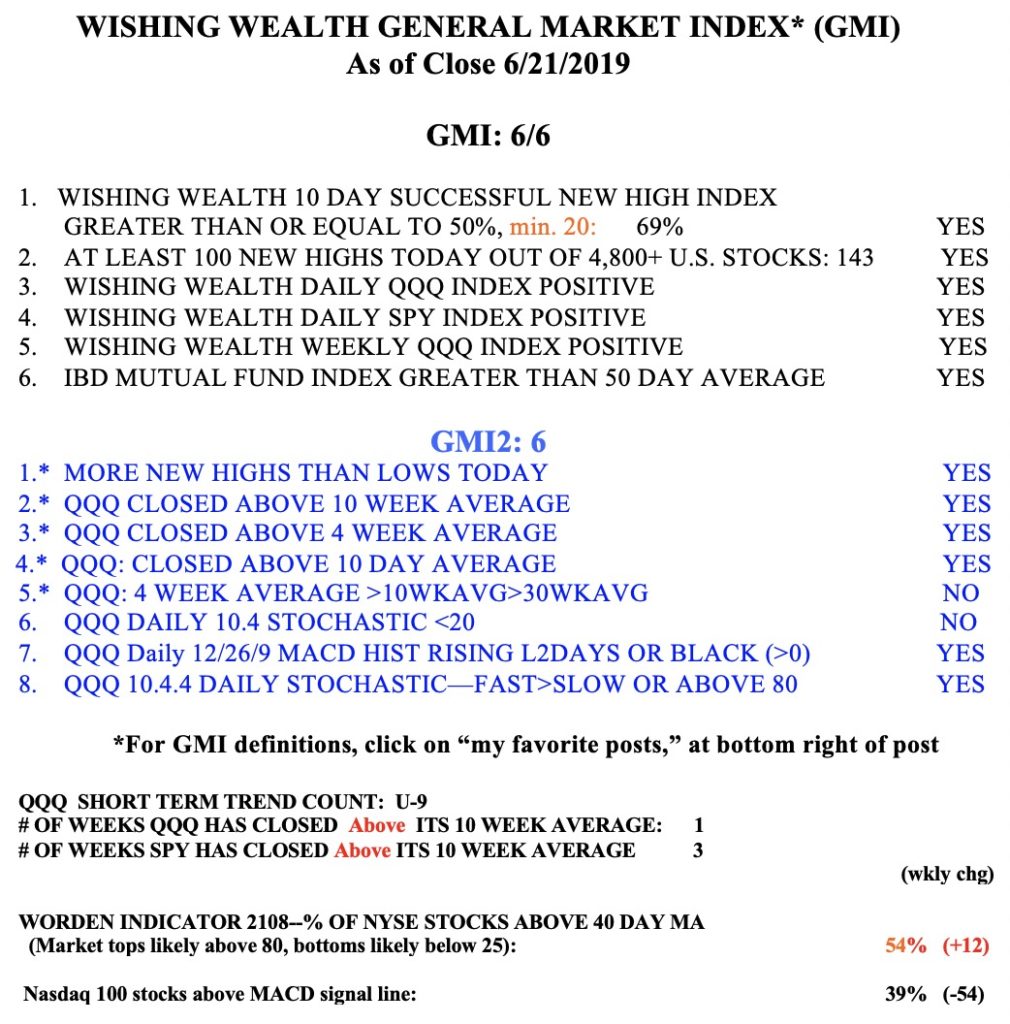

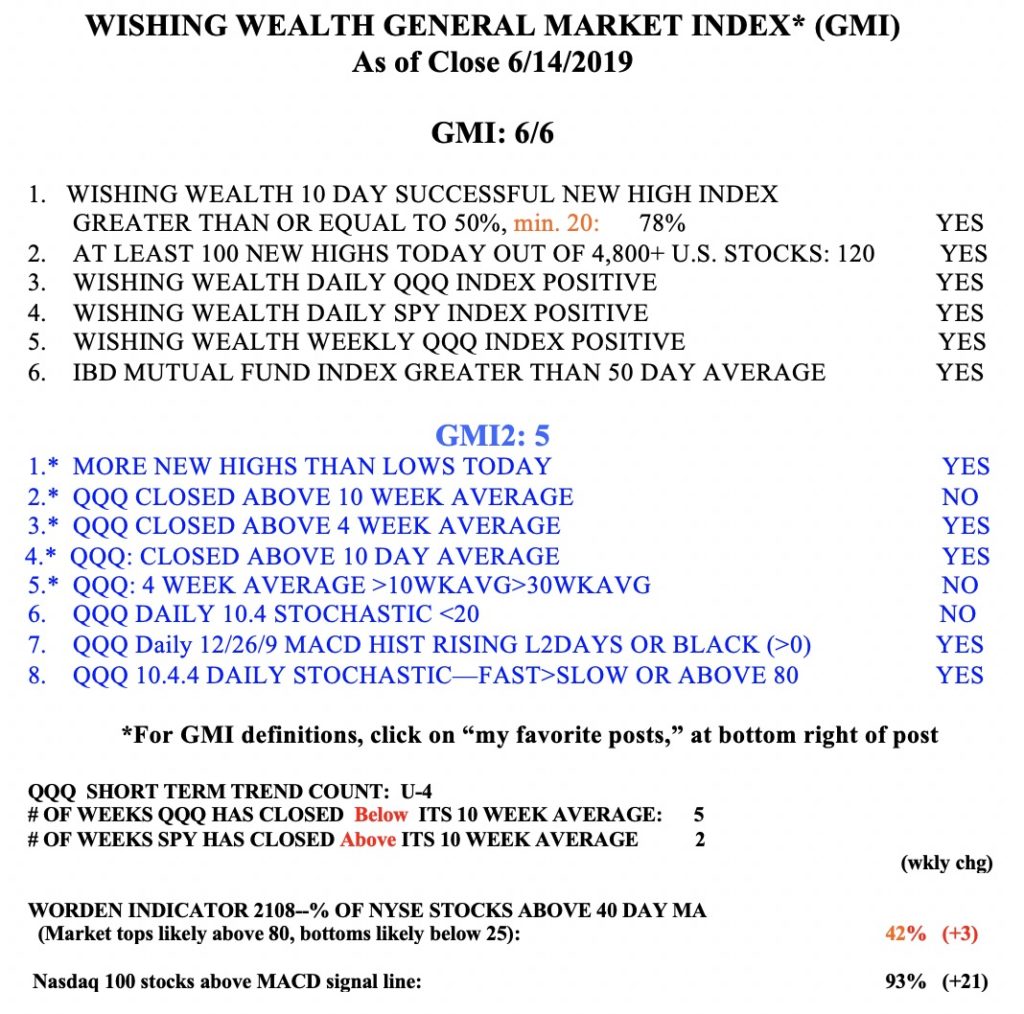

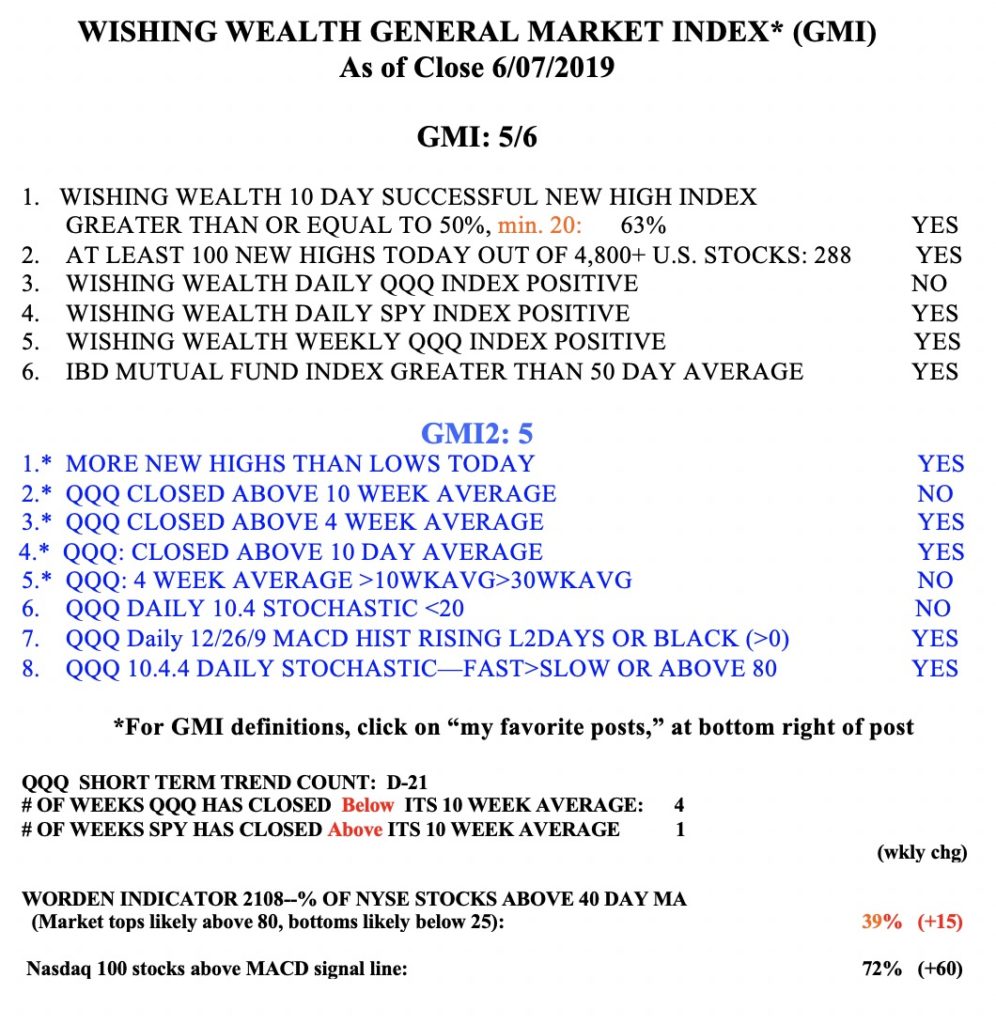

When I look at my market indicators and the charts of the major indexes, I see a rising up-trend. But when I listen to CNBC commentators I hear all the reasons not to trust this market. Jim Cramer even opines the market has it wrong. But I have heard that opinions are wrong, the market never is. I suspect Cramer has got it wrong, once again. How can I not trust a market where the GMI is Green, with 6 positive components (of 6)? Or where we see a beginning daily RWB up-trend?

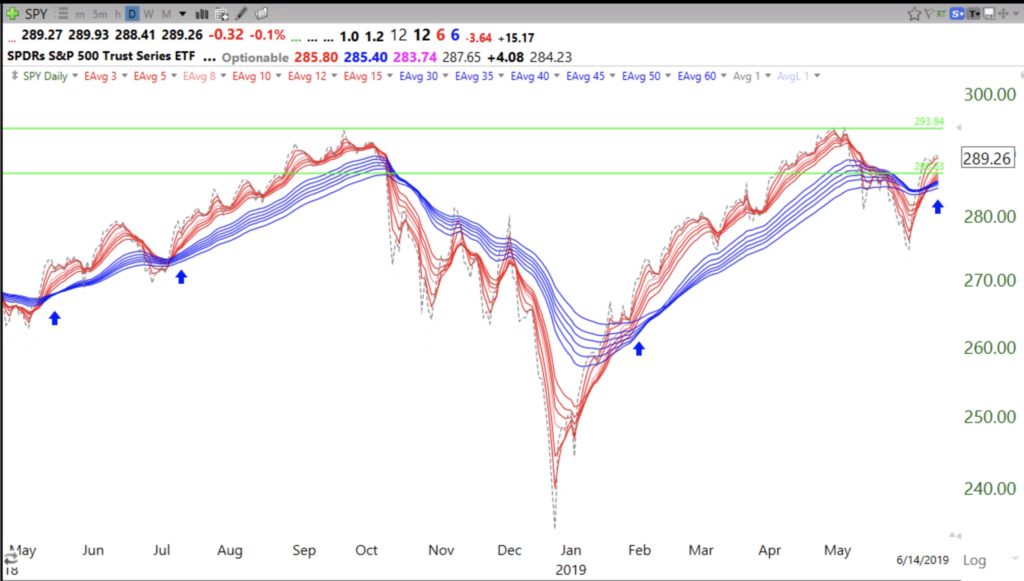

In the past, after a significant decline, I waited to go long until after the 30 week average turned up again. Look at this weekly chart of the QQQ. Note that the 30 week average (red solid line) is turning up, as is the 4 week average (red dotted line). Weinstein Stage II?

DIA and SPY tell the same story. Until these patterns fail, I am long this market.

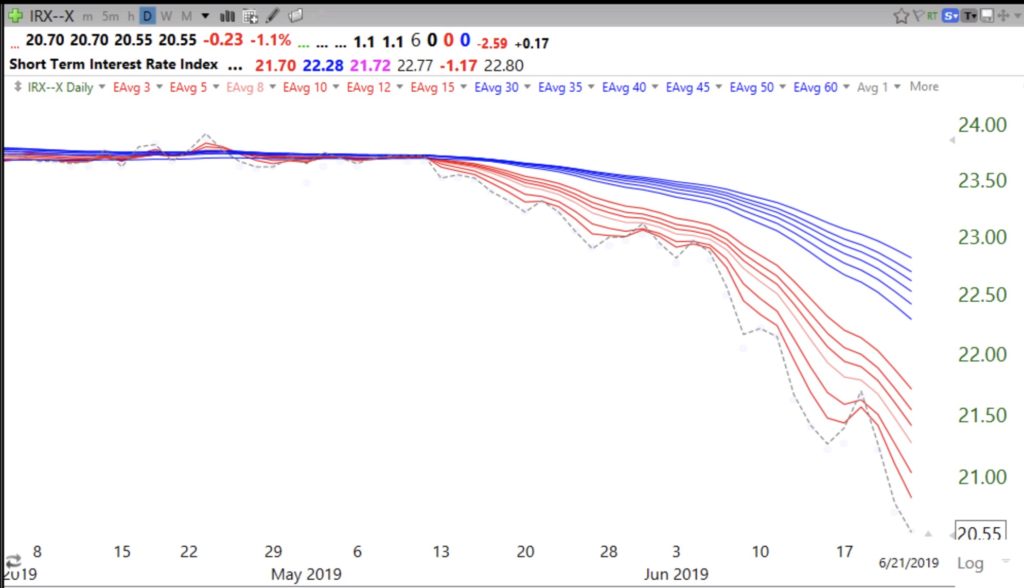

I suspect falling interest rates are behind the market’s strength. Money managers have no where to go but the equity market to grow their money.