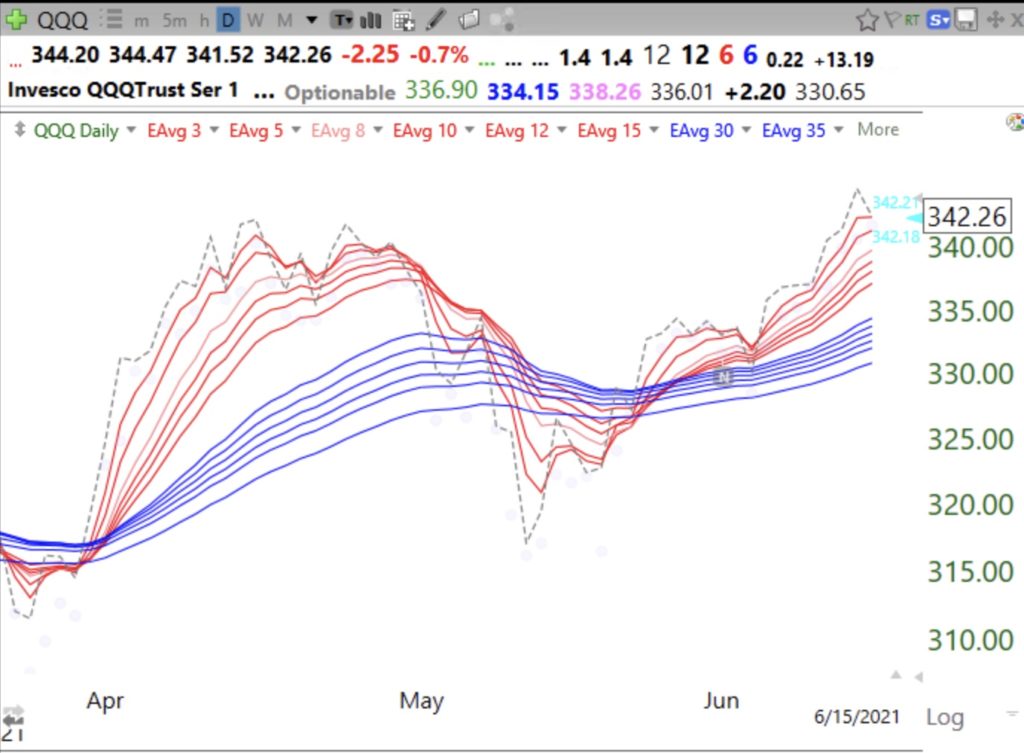

The QQQ is looking quite strong. Note that it has bounced up off of its 10 week (purple dotted line) and 4 week averages (WGB pattern) and has closed above its 10 week average (solid red line) for 10 straight weeks (Yellow Band pattern). I remain mostly invested in $TQQQ, the 3x leverage bullish ETF for QQQ. Viewers of my TraderLion presentation or last night’s talk at the Long Island Stock Traders Meetup will understand these terms. You may also go to the Topics tab on this blog and find my 2012 Houston TC2000 users group webinar. I showed in the past 2 events that in a sustained QQQ up-trend, TQQQ will outperform more than 90% of individual stocks. Since day one of the current QQQ short term up-trend on 5/26, QQQ has advanced +3.35% while TQQQ has advanced + 10.02%. Only 9 of the Nasdaq 100 stocks advanced more than TQQQ. Why not just buy TQQQ at the start of a QQQ up-trend instead of trying to identify the rare stock that will beat it? I accumulate TQQQ slowly as the up-trend continues and sell immediately when it falters.

QQQ also has a daily RWB up-trend pattern.