These 17 stocks passed my scan for stocks with recent ATHs that bounced up from oversold levels. Note that JCOM and APG report earnings this week. These stocks are provided to teach the method and are not recommendations. Study their charts and review their fundamentals. If a bounce fails, I sell immediately.

WMS, ALGN and ASGN are good examples. Note black dots indicating oversold bounces.

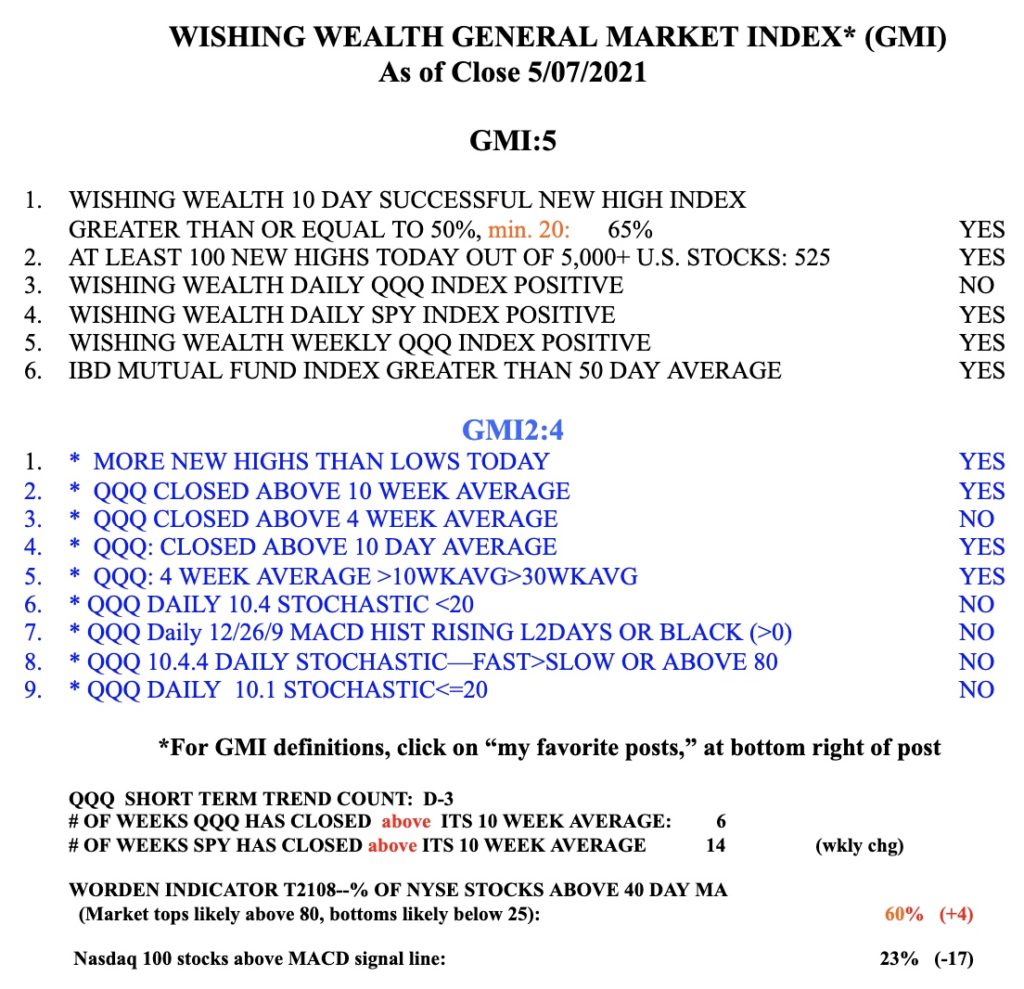

The GMI is 5 (of 6) and remains on a Green signal.

The GMI is 5 (of 6) and remains on a Green signal.