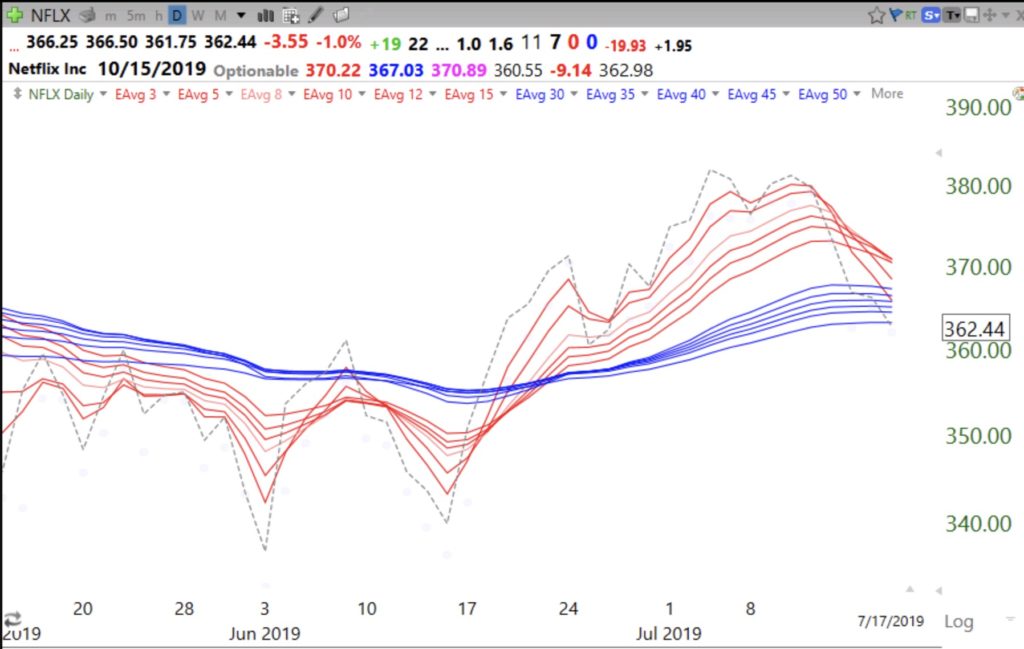

According to the rules I discussed at AAII last weekend, one could have chosen to sell out NFLX around Wednesday’s close when the daily RWB pattern disappeared and the stock was set to close below all 12 averages. An earlier sign of weakness was its close (dotted line) below all 6 short (red) averages several days ago. Or just never hold through earnings…..

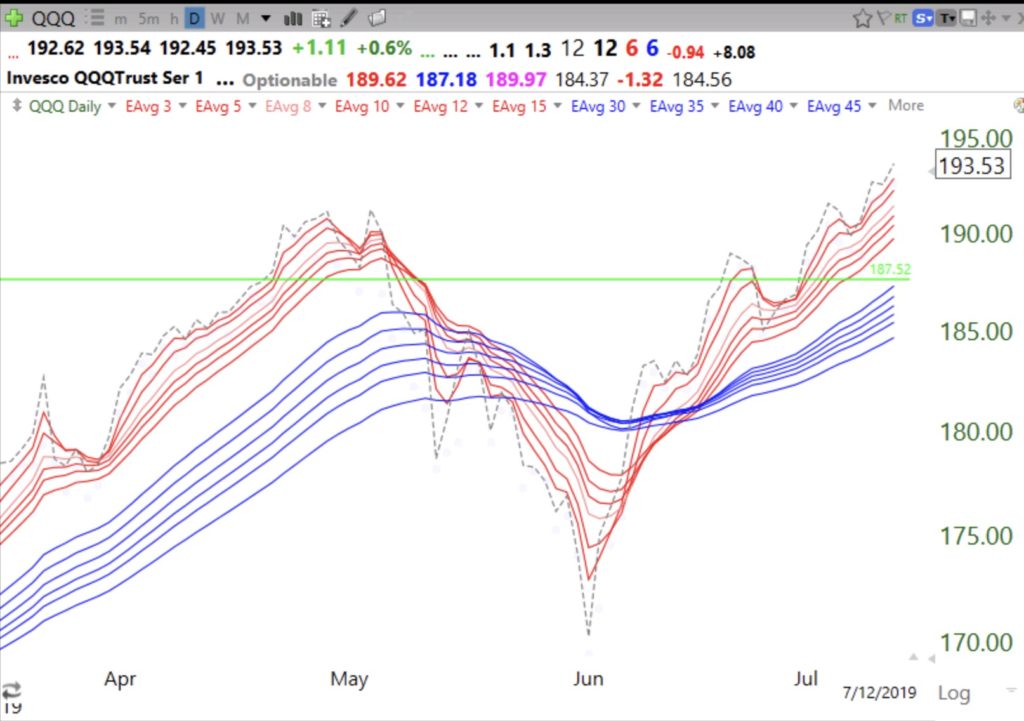

Day 24 of $QQQ short term up-trend; outline of my AAII presentation last weekend

Since the first day of the new QQQ short term up-trend, QQQ is up +5.86%, TQQQ is up + 18.19%. Only 3 Nasdaq 100 stocks (WDC, MU, SYMC) have outperformed TQQQ. Rather than trying to identify in advance the rare stocks that beat TQQQ in an up-trend, I just buy TQQQ. Below is the hand out from my AAII presentation last weekend. It is an outline of my talk. The focus was a conservative strategy for older persons and trades index ETFs rather than individual stocks. Most of the terms here are defined in my blog’s glossary. These are my rules and are not advice but are provided for educational purposes only. Everyone needs a set of rules.

Wonderful DC AAII meeting; Riding $SPY and $TQQQ; Our free spring lunchtime workshop course at the university…

I had a wonderful time presenting to the DC metro chapter of the AAII in Virginia. I was pleasantly surprised to see that the youngest person there was a former student of mine who attended with his father and uncle! David and I presented slides from our undergraduate course and we focused primarily on investing in index ETFs rather than growth stocks. This conservative strategy was most appropriate for a largely gray haired audience, like myself. What a terrific audience. I also announced that David and I are planning a free multi-week lunchtime course on stock trading at the University of Maryland library that will be open to the public. I will announce details here in December. The course will be planned for spring semester next year. The toughest problem will be navigating and parking at the campus. I realize that I did not tell the audience about an extensive webinar I did for a Worden TC2000) workshop in Houston in 2012. Here is a link to it. You can also access it from the webinar list at the top of this blog.

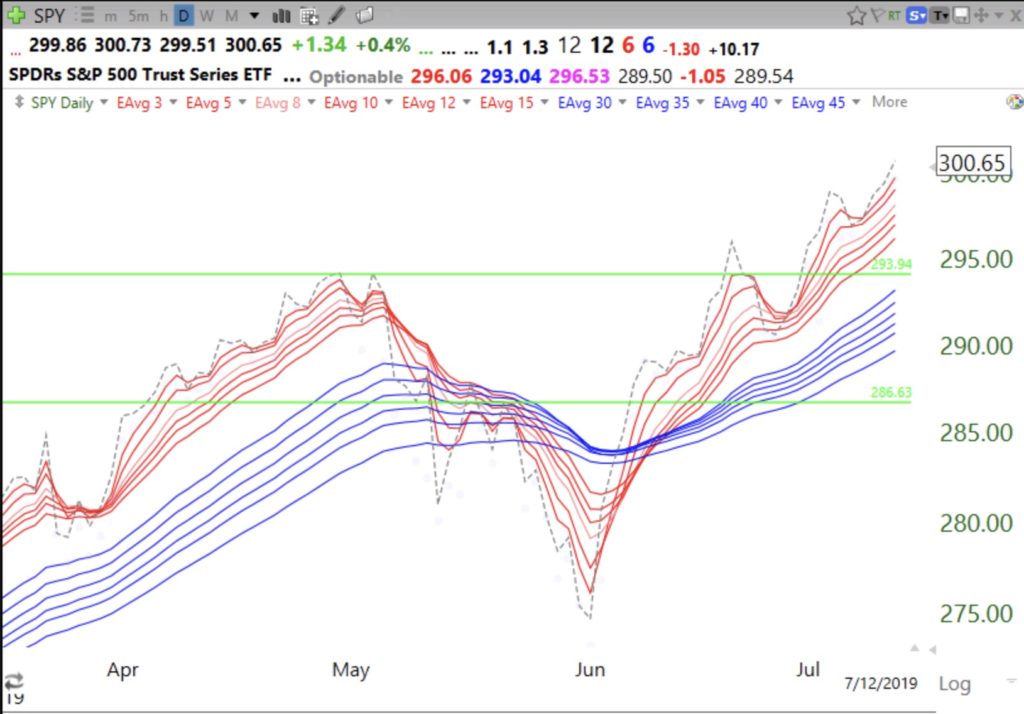

I am riding SPY and TQQQ during this market up-trend. The daily RWB pattern is just too strong to ignore. As I told persons on Saturday, I do not argue with the market or listen to media pundits. I simply follow the general market’s trend until it ends. Check out these beautiful daily RWB patterns in the QQQ and SPY.

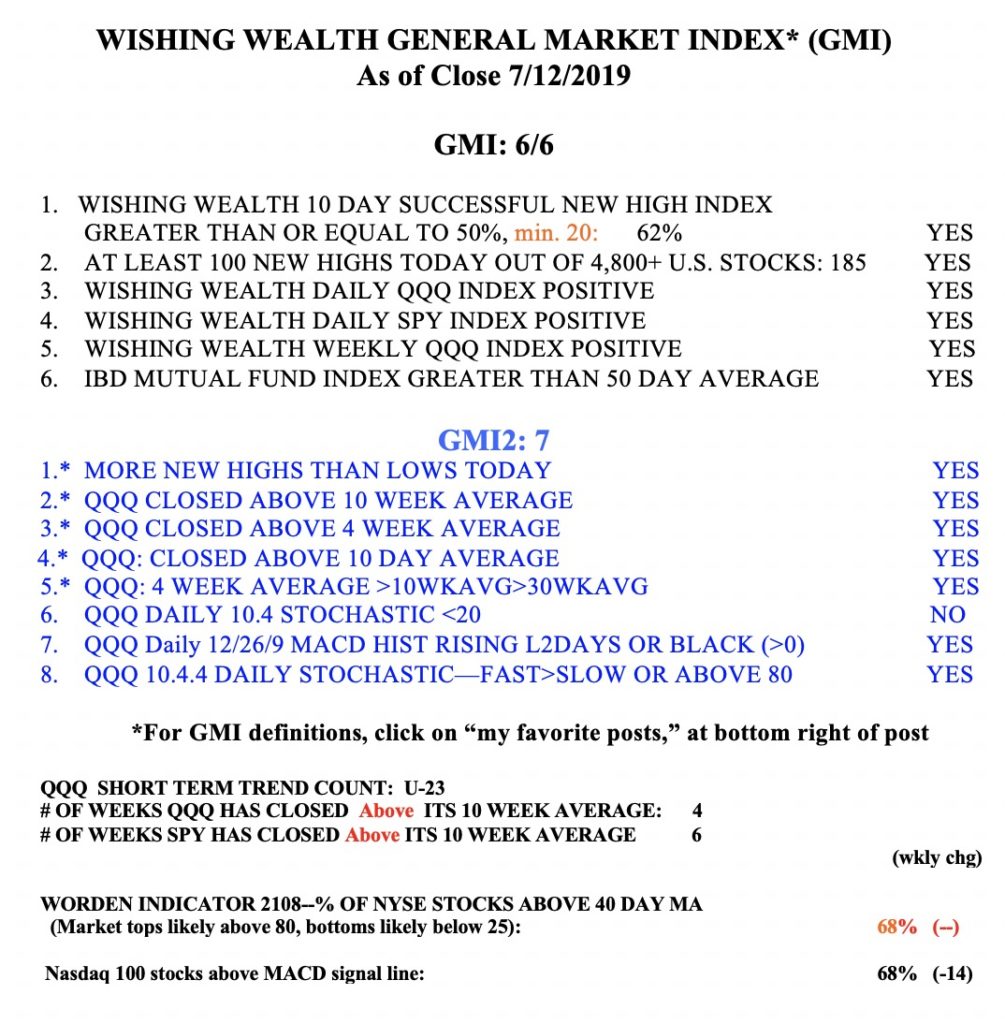

And the GMI signal remains Green at 6 (of 6).