A nice set-up on a weekly chart is when a stock in an up-trend (10 wk average rising above 30 week average) bounces up off of its 10 week average. It also helps if the stock has had a recent GLB and is trading near its ATH. A good example of this set-up was TEAM last week. If I bought this set-up, I must sell with a weekly close back below the 10 week average. Note how this set-up would have played out last August-September. (10 wk avg is blue dotted line)

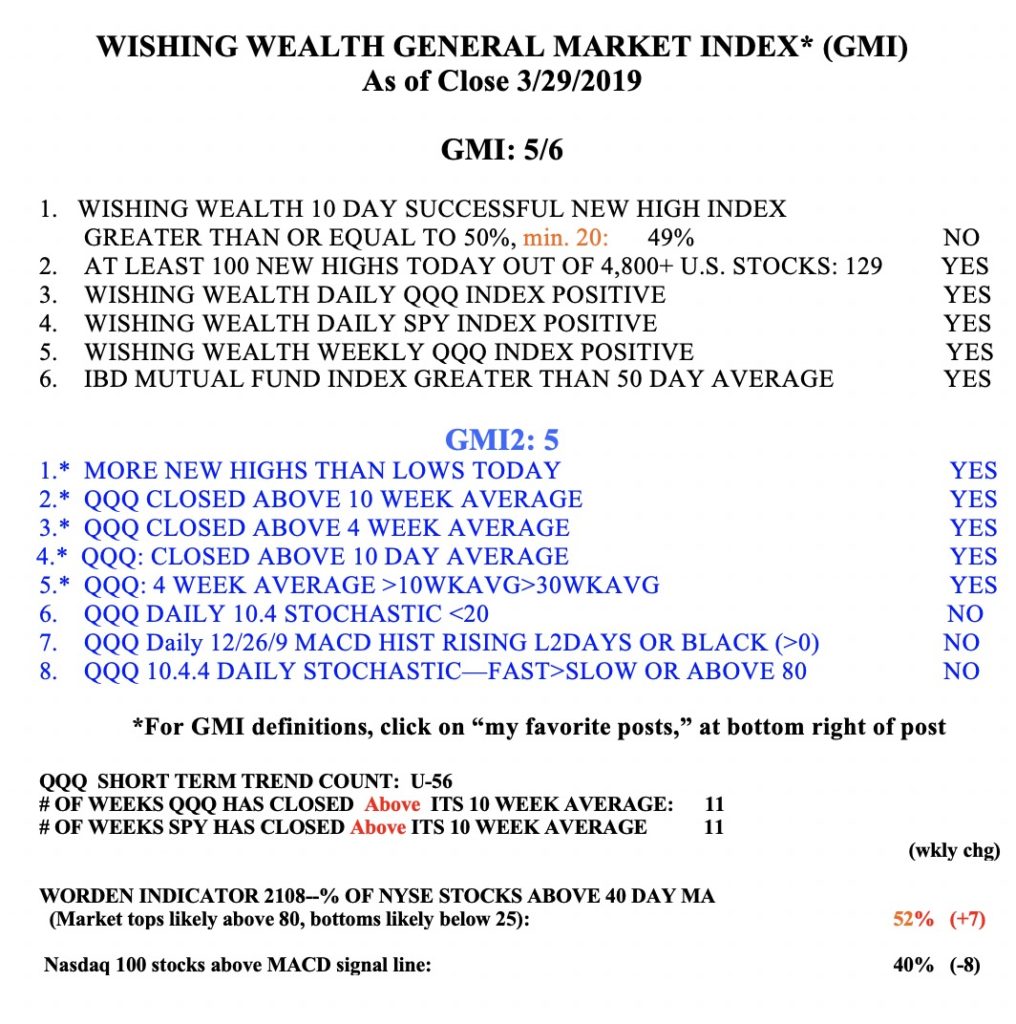

The GMI remains Green.