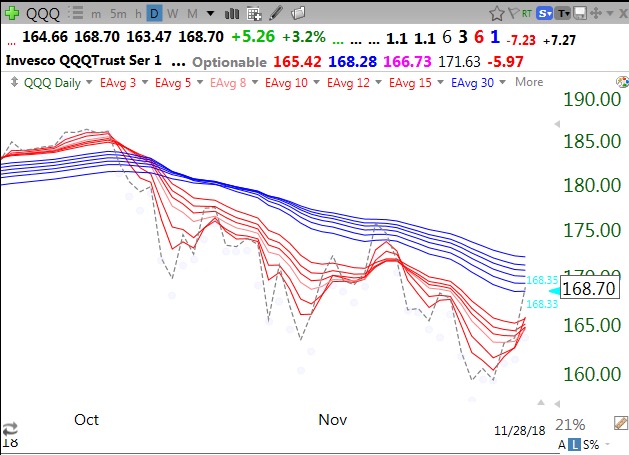

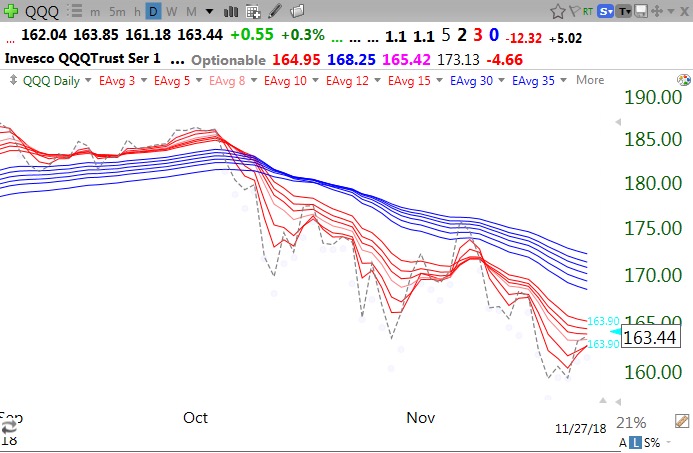

While IBD announces new market up-trend after a follow through day on Wednesday, the daily Guppy chart still shows a BWR down-trend. A close (dotted line) above all of the blue lines (longer averages), currently around 192, would suggest a possible change in trend. More meaningful would be if all of the red lines could rise above the blue lines in an RWB up-trend pattern.

Select stocks hitting an ATH on Wednesday: AMED, SHEN, AXP, MSI, LHCG, UNH, OMCL, VCRA, GBCI, YETI, HELE. YETI reports earnings on Thursday.