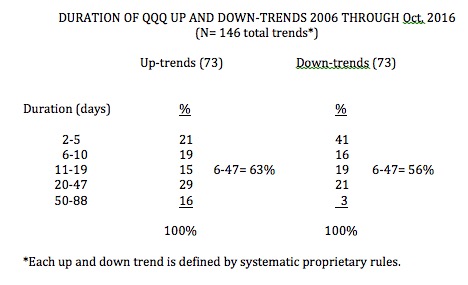

I updated my analysis from 2013 of how long QQQ short term trends last. The findings are remarkably similar: (To see the results from 2013 click here.)

It is clear that short term up-trends last longer than down-trends. In fact, 41% of down-trends ended within 5 days, compared to 21% of up-trends. But 63% of up-trends and 56% of down-trends lasted from 6-47 days. Up-trends were 5x more likely than down-trends (16% vs. 3%) to reach 50+ days. Thus, while Friday was the first day of a new short term QQQ down-trend, I will not wager much on it (by buying SQQQ) until it reaches beyond 5 days. Keep in mind that any move might last longer than those in the table if they have a few brief trend changes in the middle. For example, 25 days up, 3 days down and another 20 days up. In the past, I have found success buying TQQQ when the short term trend turns up. I often follow this strategy using the GMI signals, which are different from the short term trend signals. I have shown that that strategy outperformed about 95% of individual stocks. (It is hardest psychologically to buy when the trend or GMI first changes to up because one is often licking his wounds and gun shy from the prior down-trend.)

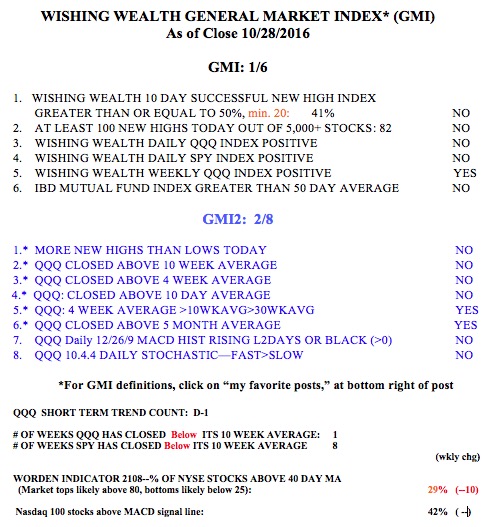

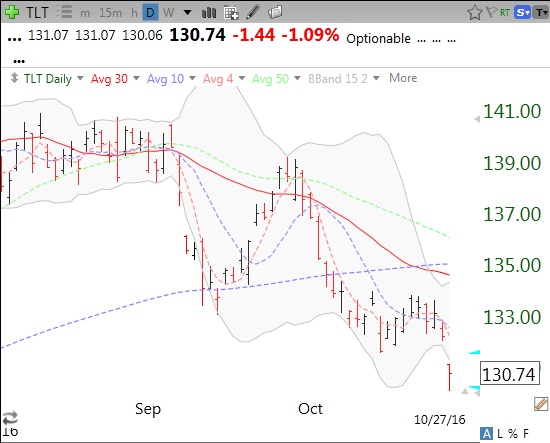

Meanwhile, the major indexes are looking weak. The SPY has closed below its critical 10 week average for 8 straight weeks and the QQQ has now closed below its 10 week average. I found in the past that I was unlikely to make money going long growth stocks when the QQQ was below its 10 week average. And the GMI is 1 and RED, with only the Weekly QQQ component positive. This component means the QQQ remains in a Stage 2 up-trend. But the remaining critical indicators in the GMI are all negative. The IBD Mutual Fund Index is below its 50 day average, indicating that the pros cannot trade growth stocks profitably. No wonder it has been difficult for me to successfully trade growth stocks recently. As William O’Neil and Nicolas Darvas urged, it s much safer to trade consistent with the trend of the major market averages. I do not fight the general market’s trend.